If you are a U.S. person or subject to taxation as a U.S. person, or if you are a corporate and the entity is incorporated in the U.S., then you must submit the W-9 tax form to receive payouts.

A U.S. person is:

- An individual who is a US citizen or US resident alien.

- A partnership, limited liability company, corporation, company, or association created or organized in the United States or under the laws of the United States.

- An estate (other than a foreign estate), or

- A domestic trust (as defined in US tax regulations).

To submit the W-9 tax form:

-

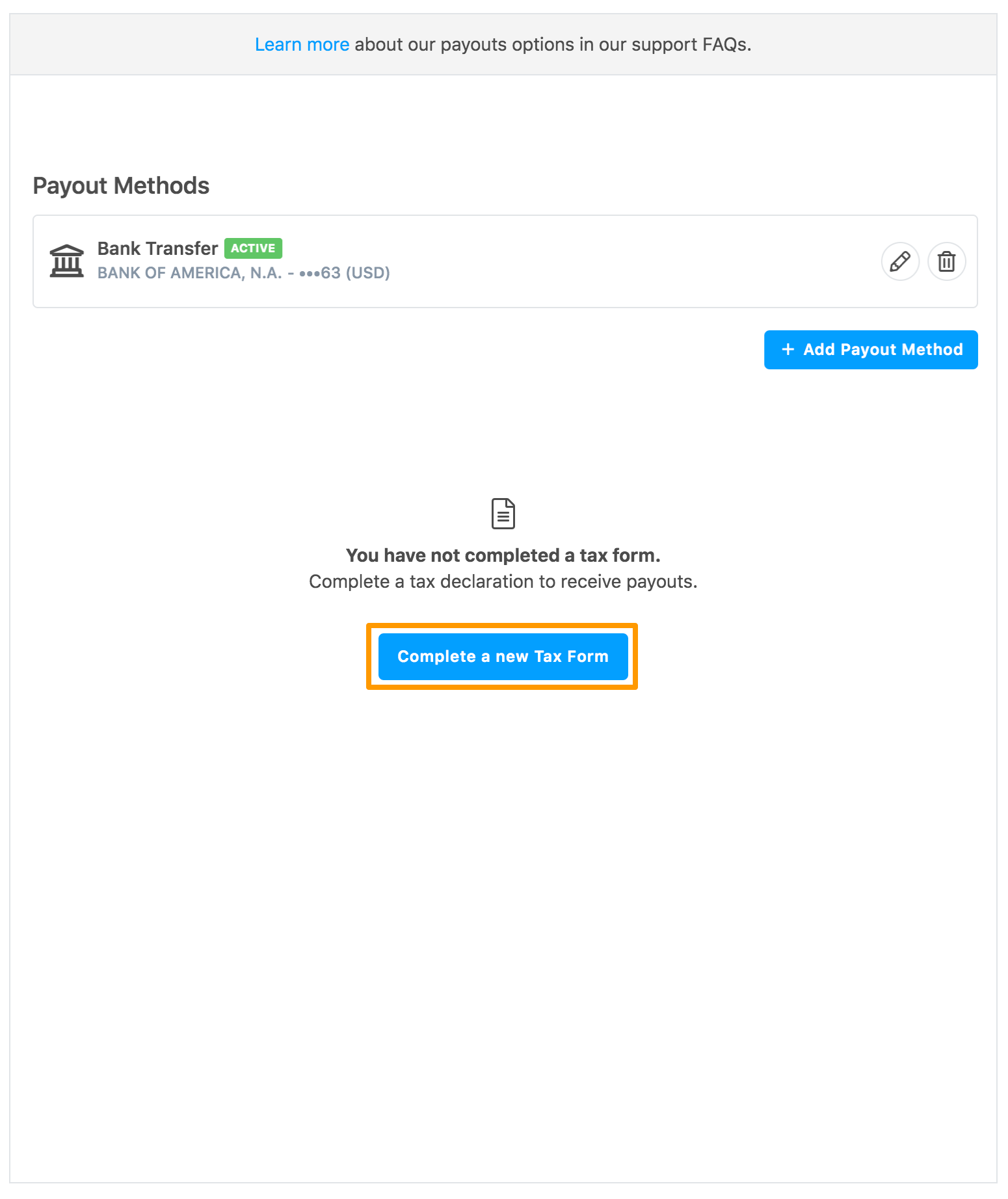

In the Payout Methods section, click Complete a new Tax Form.

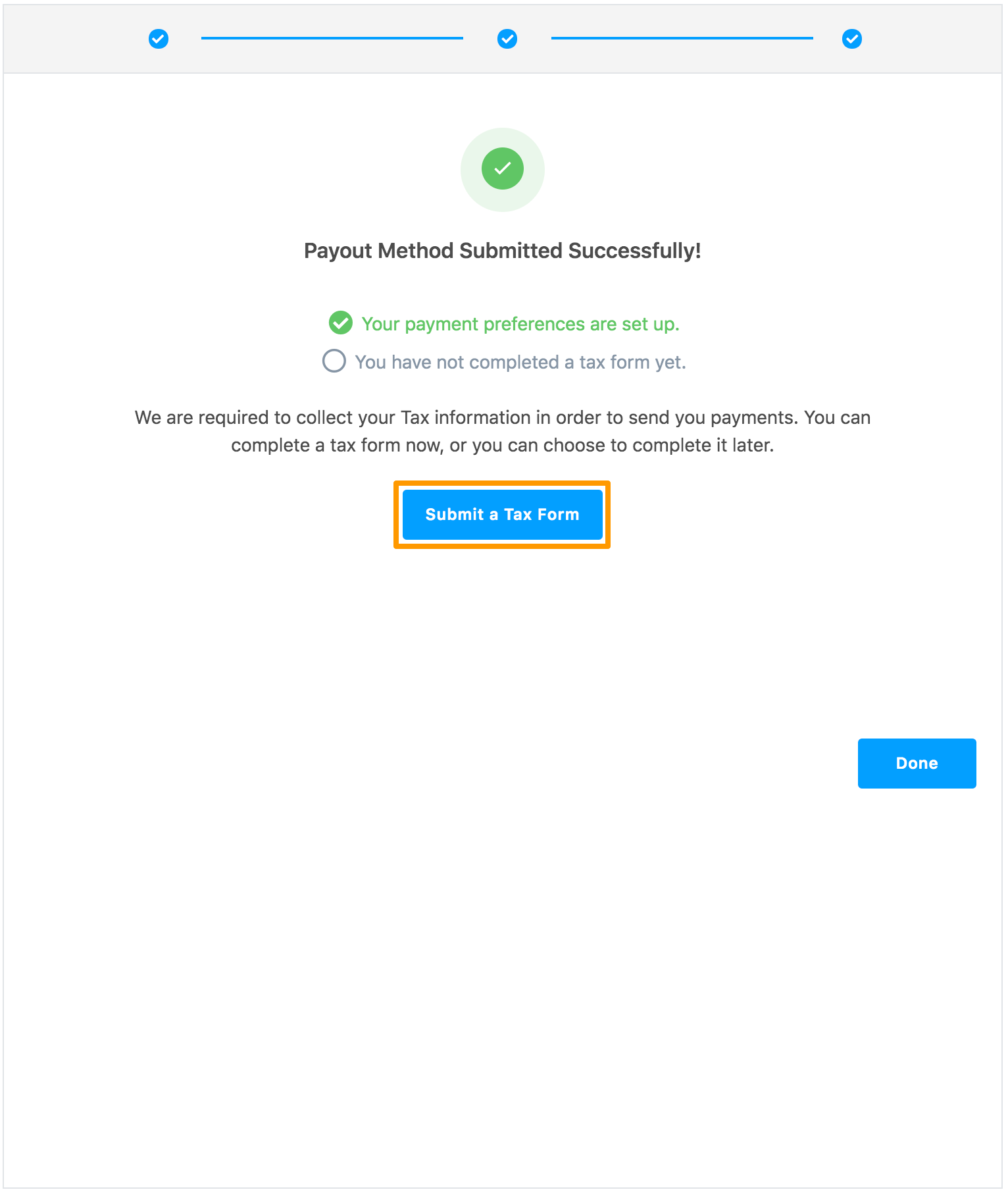

After you add a payment method successfully, you can also submit the tax form.

Click Submit a Tax Form.

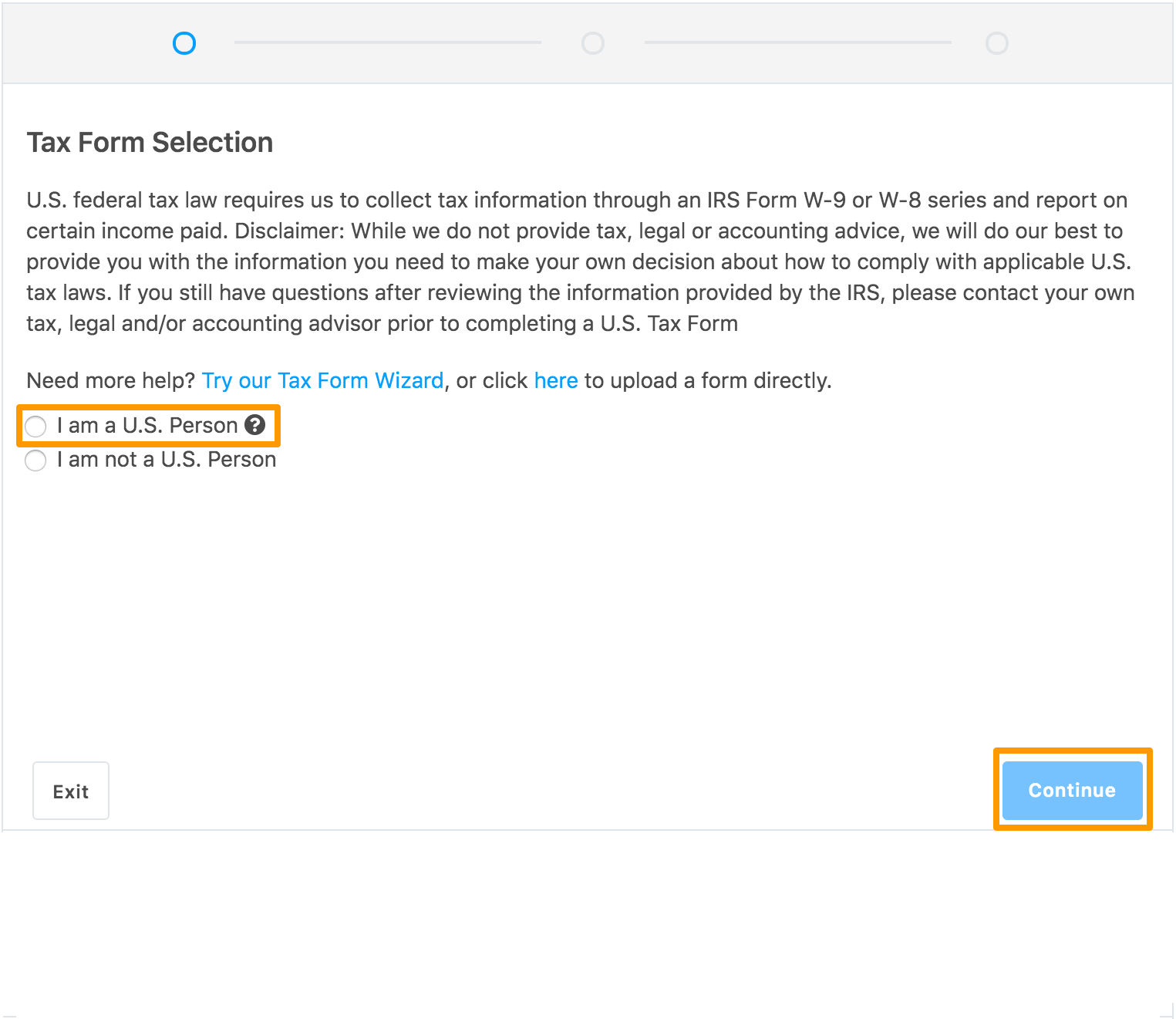

The Tax Form Selection page is displayed.

-

Read the displayed information.

-

Select I am a U.S. Person and click Continue. If you have a completed form file in your local system, then click the here link and upload the form. For information about uploading the form, see uploading tax form.

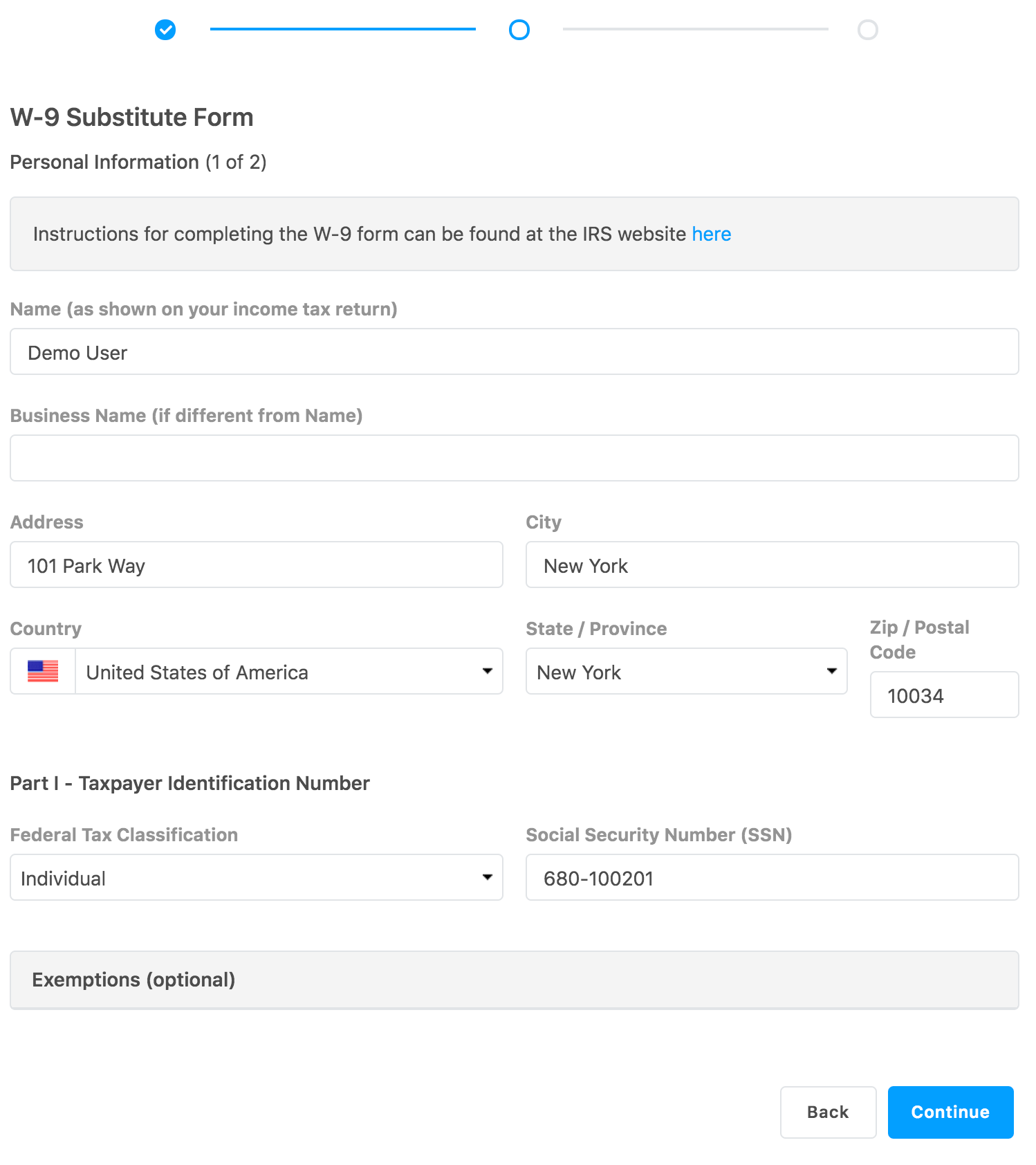

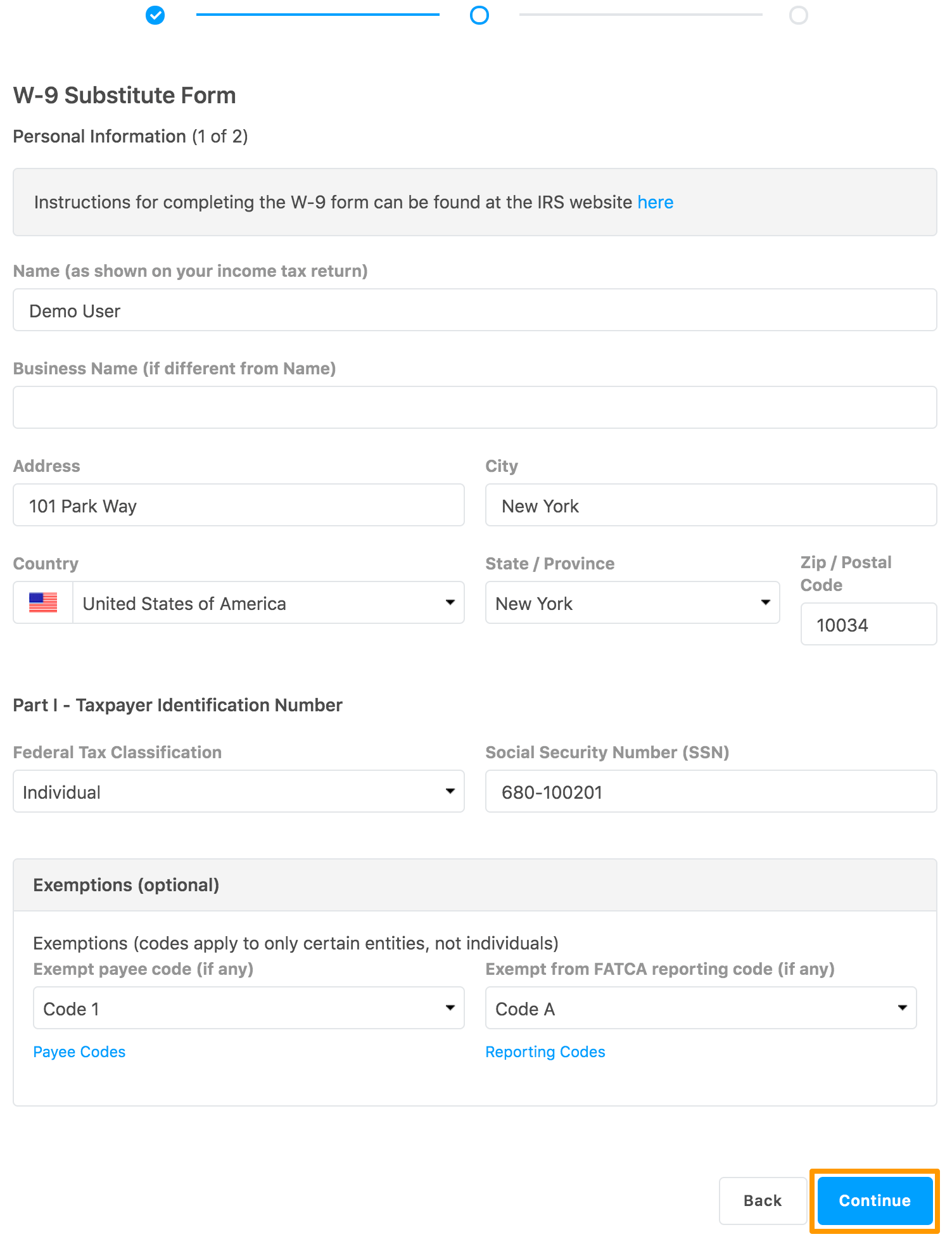

The W-9 Substitute Form section is displayed.

Specify your personal information in the following fields:

- First/Given Name

- Last/Family Name

- Business Name (If different from Name)

- Address

- City

- Country

- State/Province

- Zip/Postal Code

- Federal Tax Classification: Select your tax classification.

- Social Security Number: Specify your Social Security Number in the XXX-XX-XXXX format. This field is displayed based on the selected tax classification.

- Employer Identification Number (EIN): Specify your Employer Identification Number in the XX-XXXXXXX format. This field is displayed based on the selected tax classification.

- Tax Identifier Type: If the tax classification is selected as Trust, then this field is displayed. Select the Social Security Number or Employer Identification Number option and specify the SSN number or EIN number, respectively.

To update information in the preceding section, see IRS instructions for W-9 form.

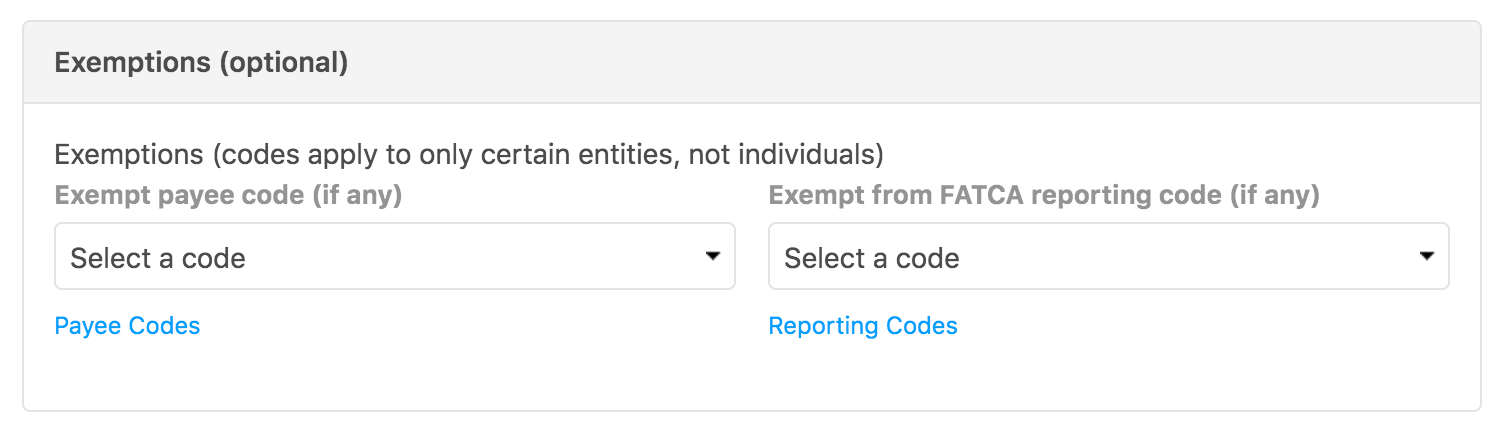

Click Exemptions (optional). The Exemptions section is displayed, which is optional.

Specify the following:

-

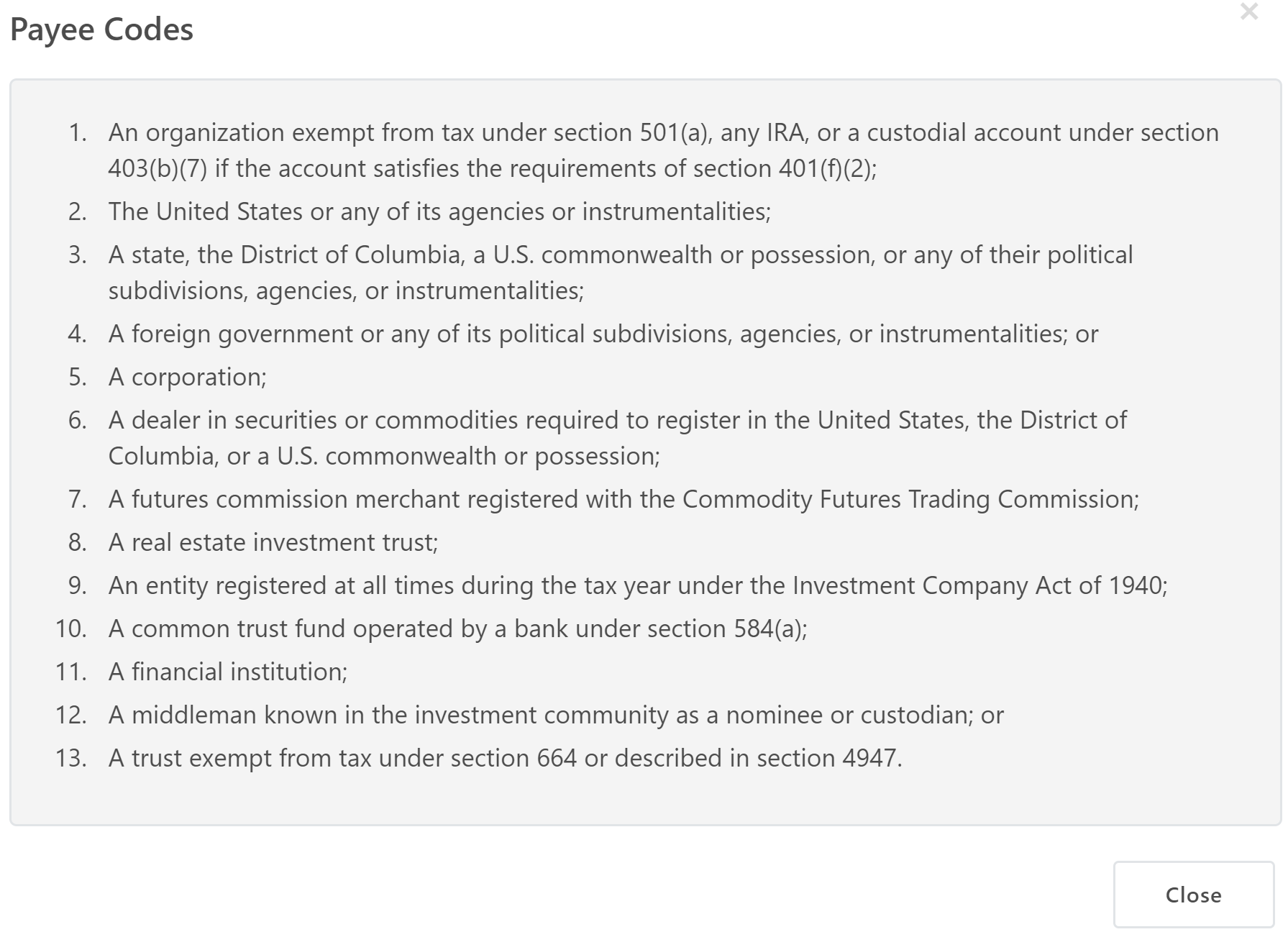

Exempt payee code: Select a code from 1-13. Click Payee Codes to view the description for each code.

-

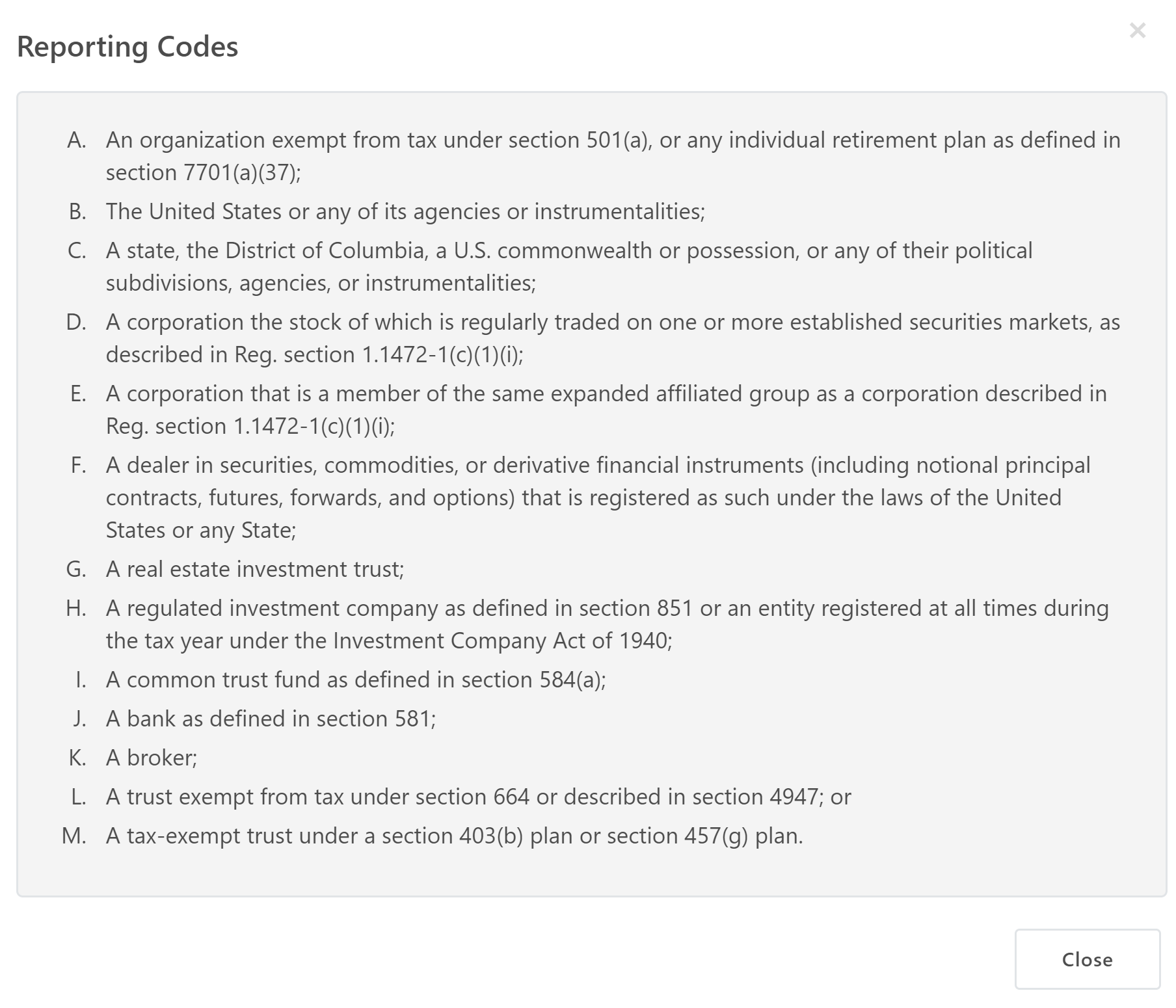

Exempt from FATCA reporting code: Select a code from A-M. Click Reporting Codes to view the description for each code.

-

Click Continue.

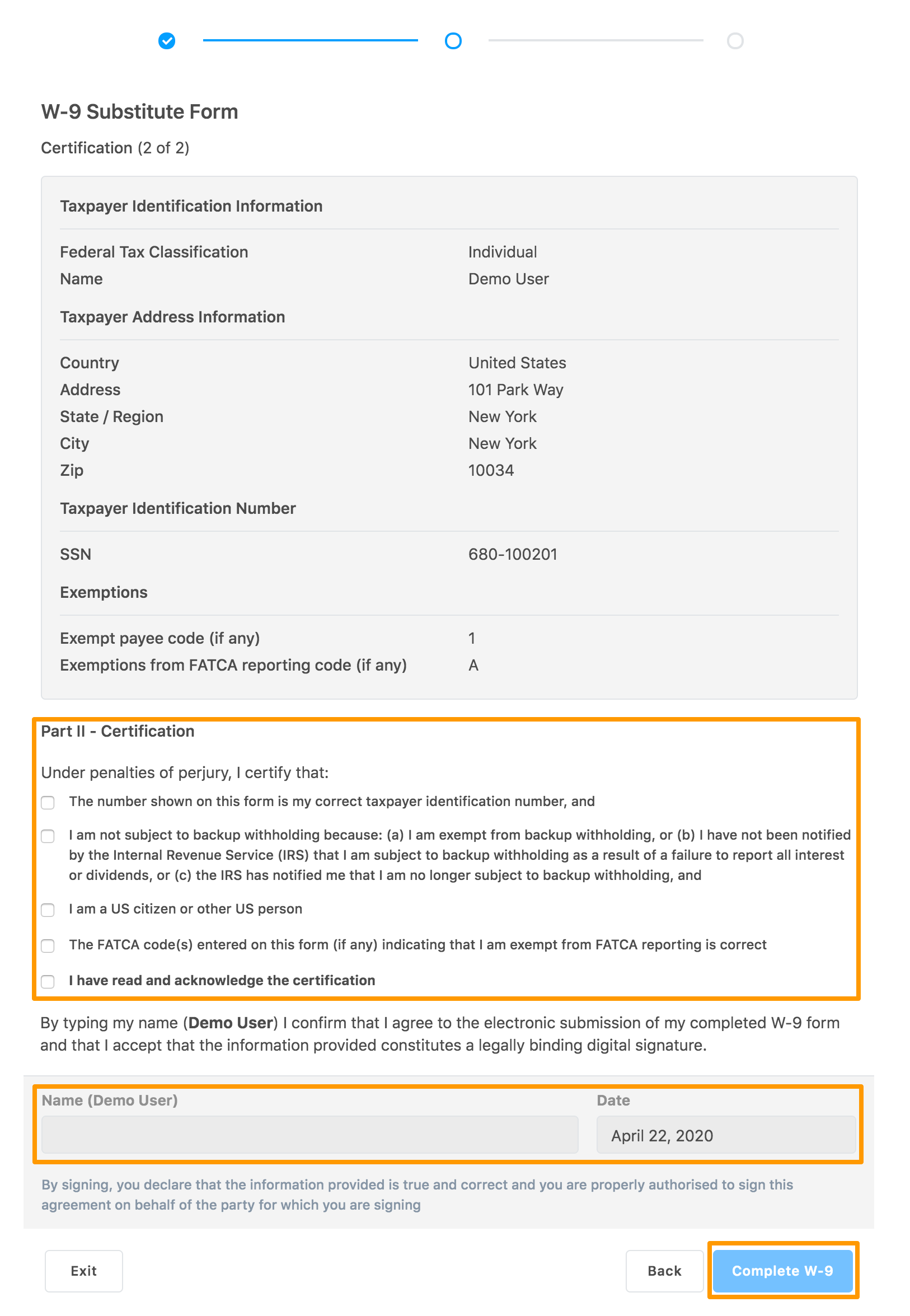

The second part of the form is displayed.

-

Select all the displayed options, specify your name as per the name on your income tax return, and click Complete W-9.

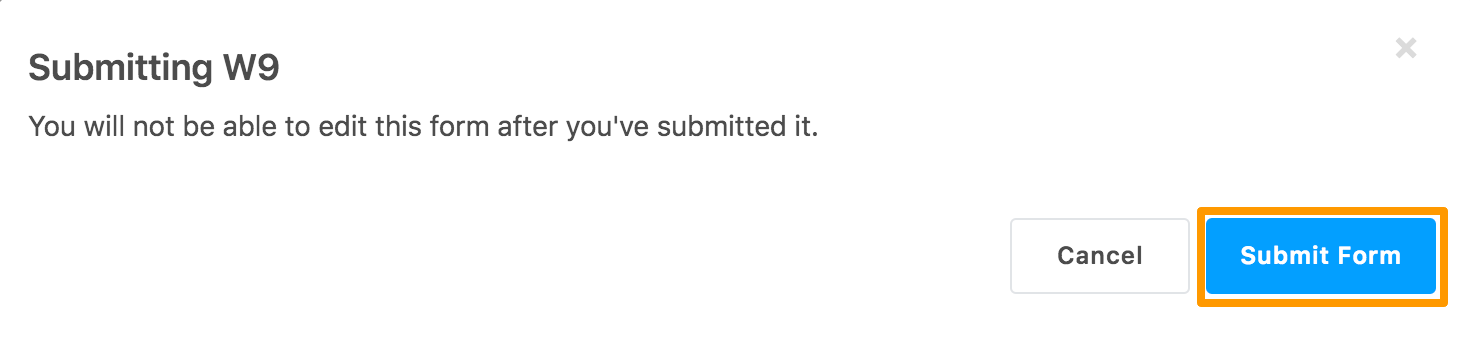

A warning pop-up message is displayed indicating that you will not be able to edit the form after it is submitted.

-

Click Submit Form.

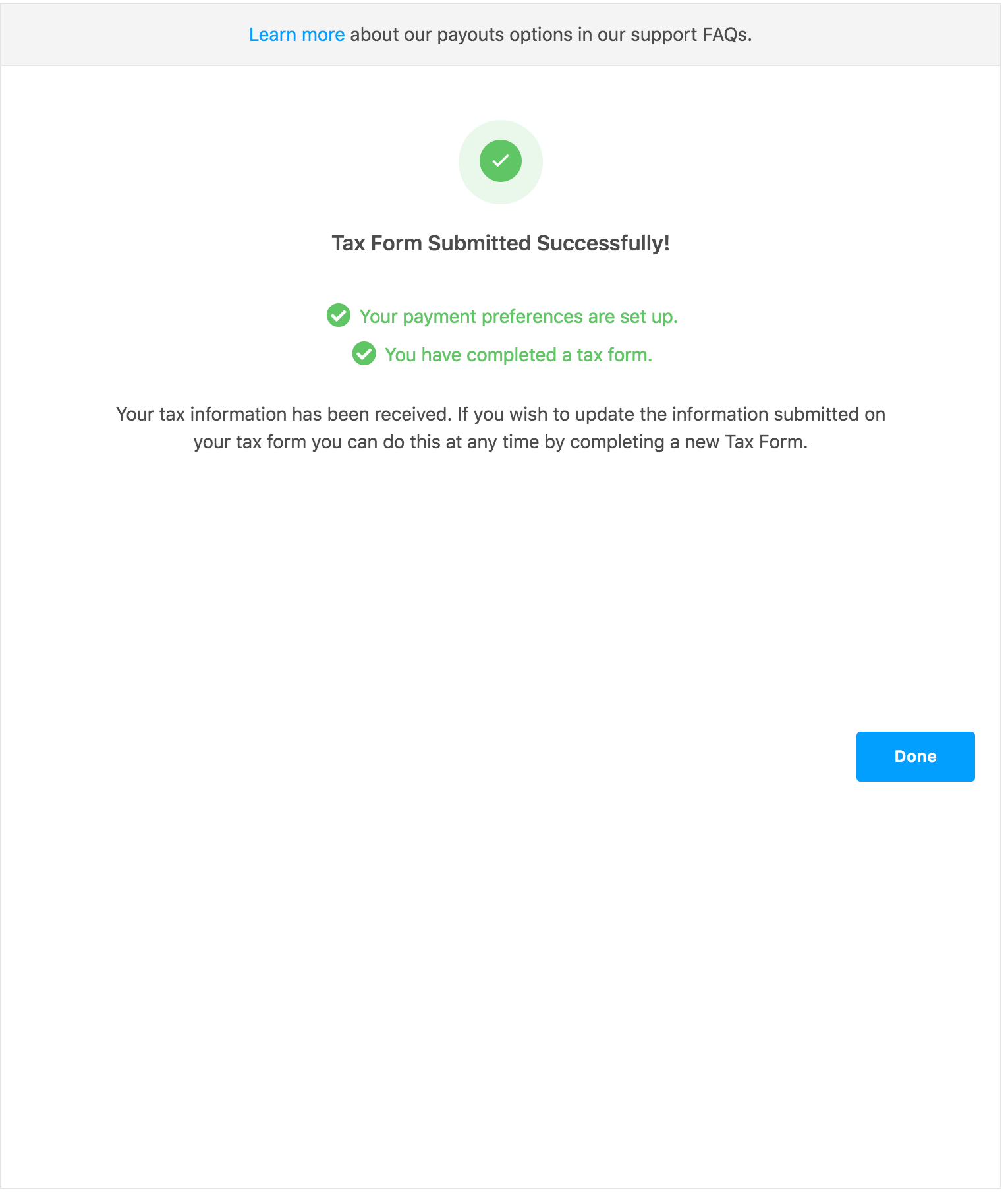

The following confirmation message is displayed.

-

Click Done to close the message.

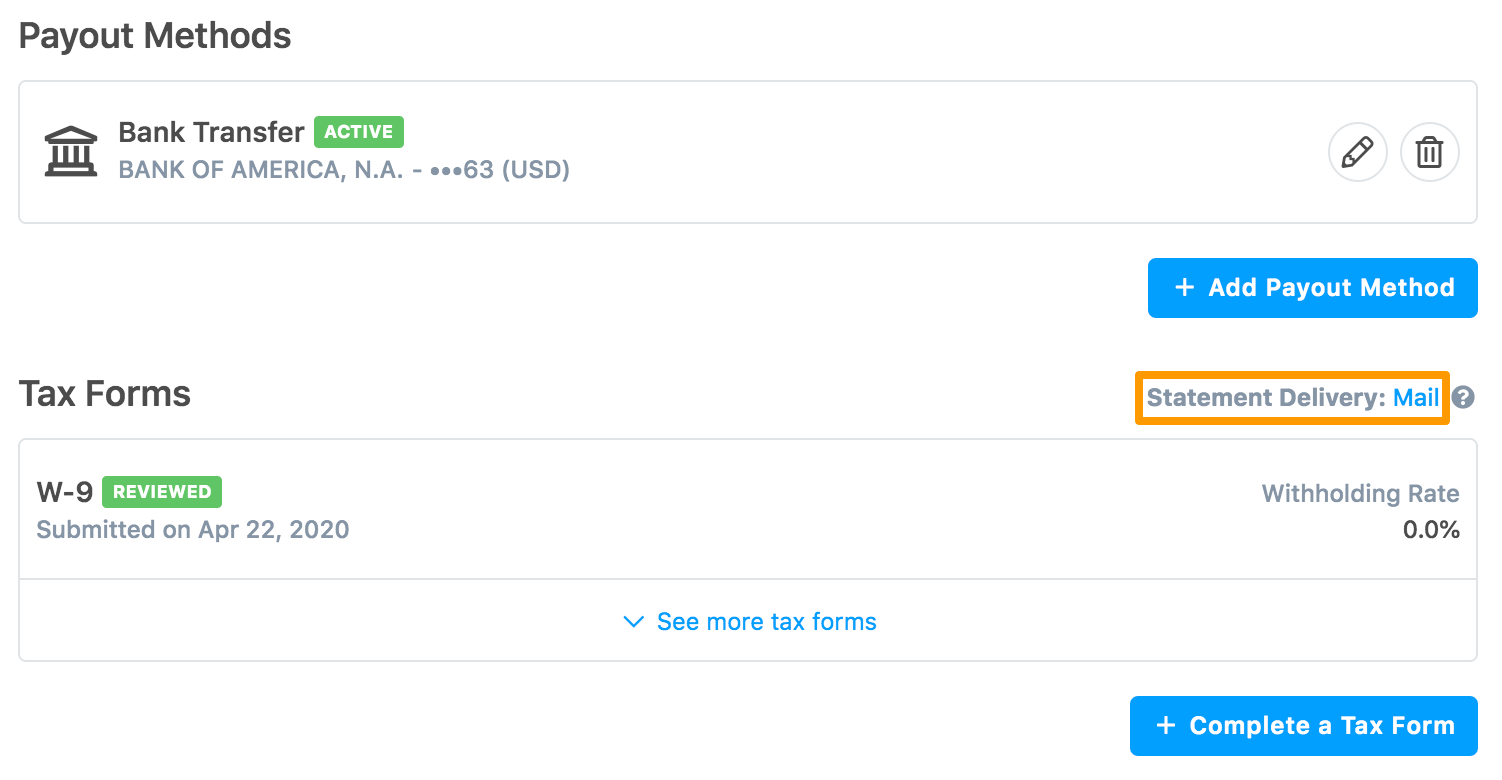

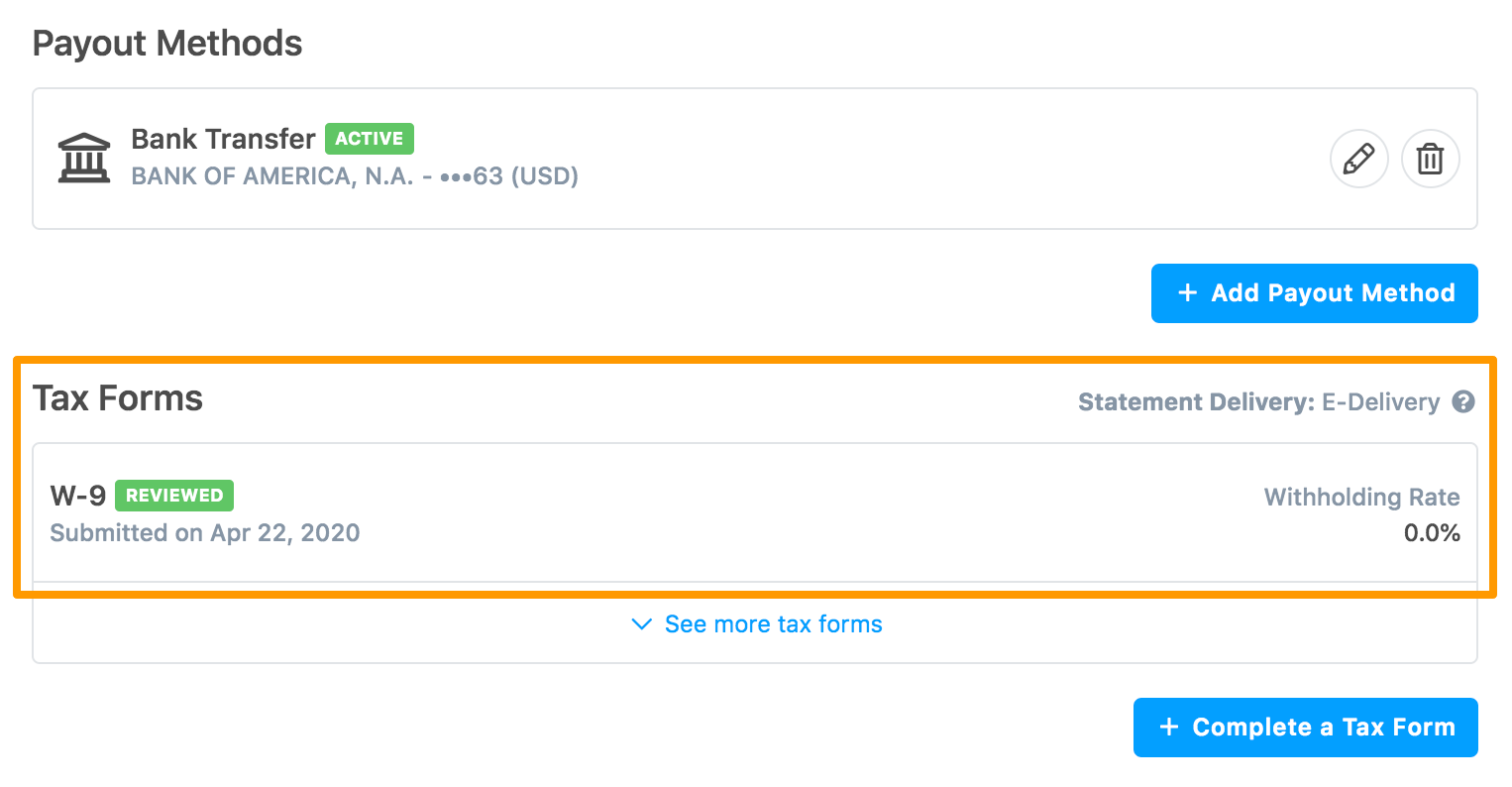

The submitted tax form is displayed in the Tax Forms section.

-

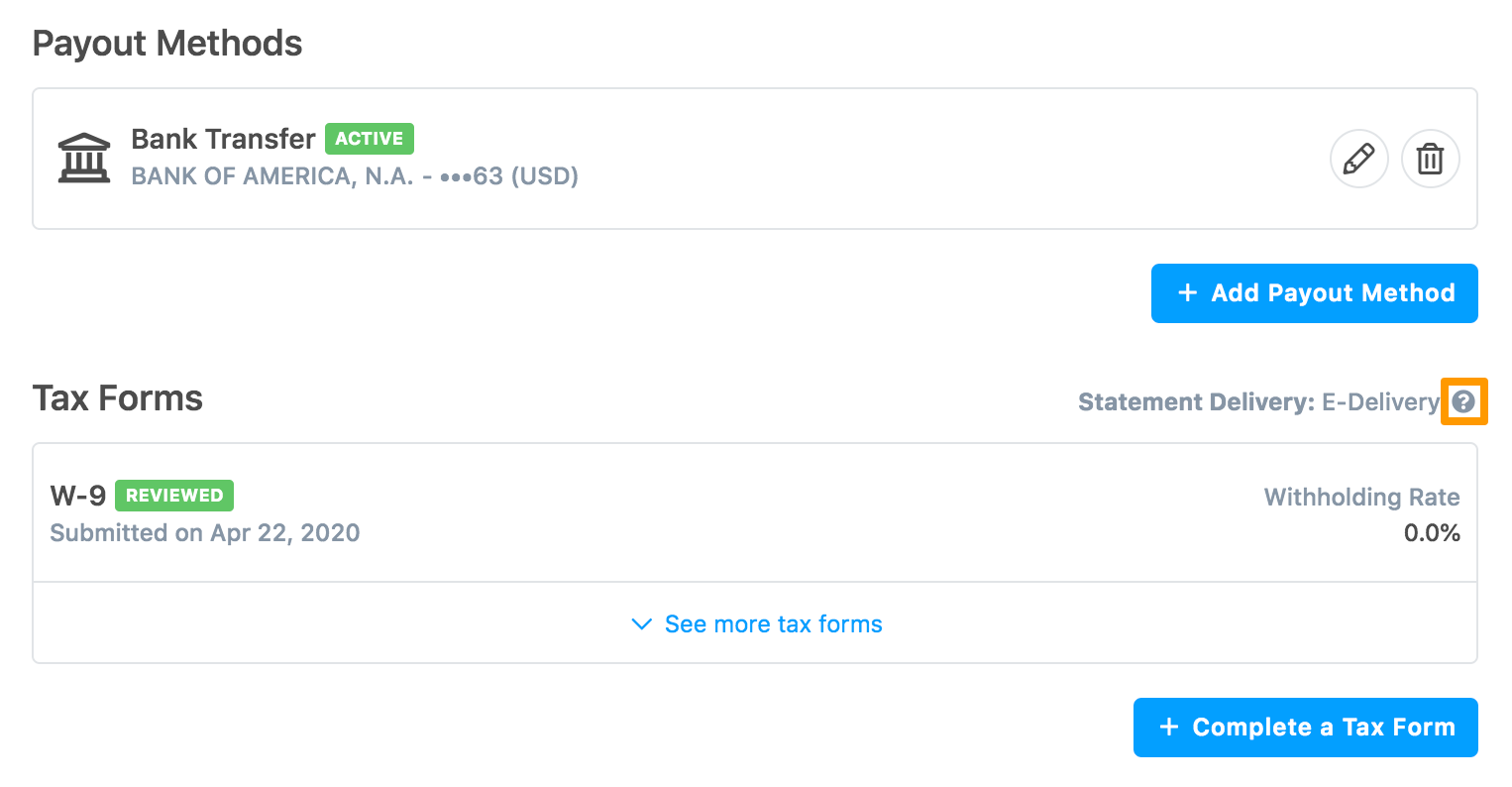

In Statement Delivery, click the question mark icon for specifying the tax statement delivery method. By default, it is E-Delivery.

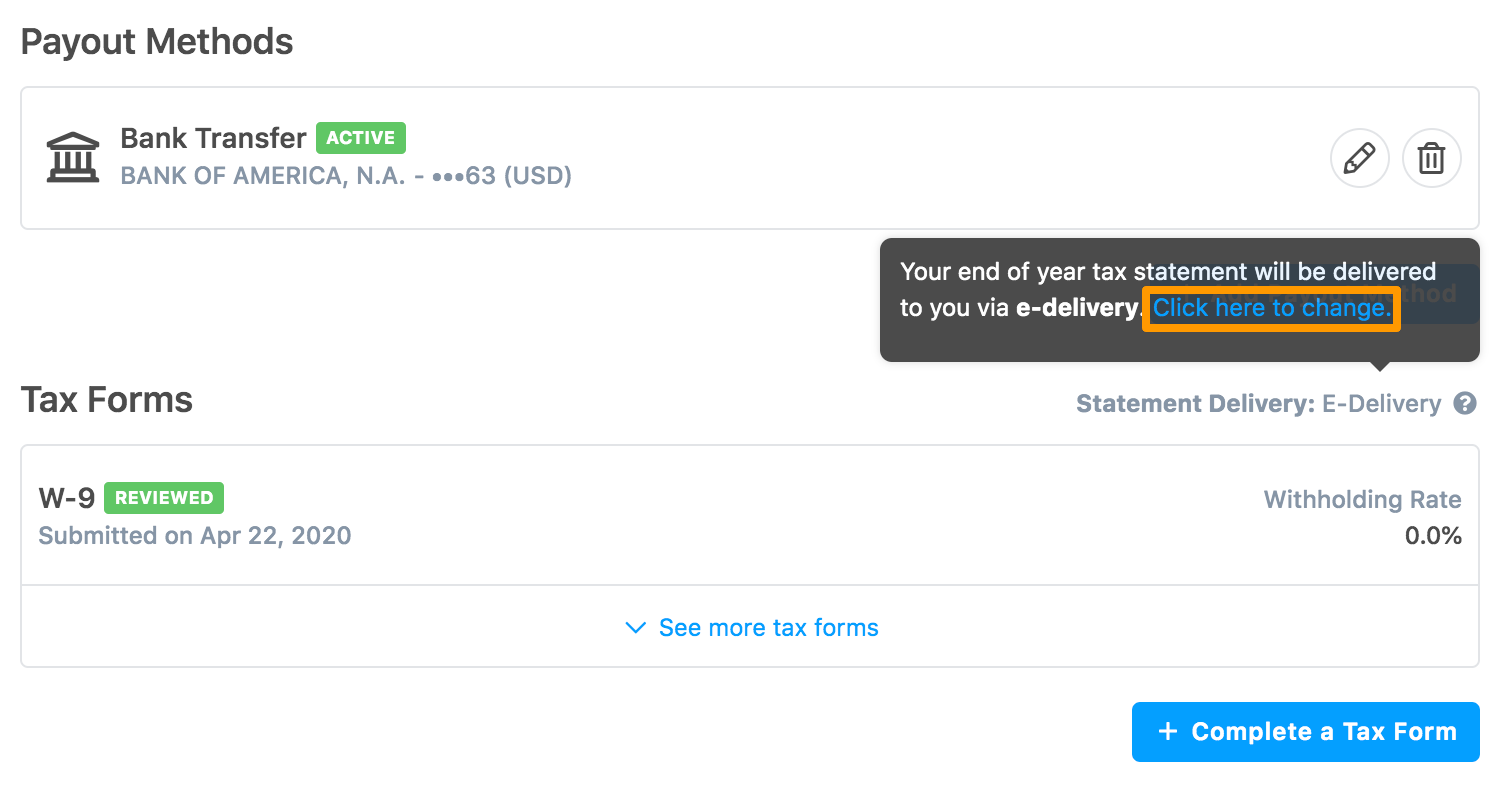

A pop-up message indicating the current delivery method is displayed. Click the link to change the tax statement delivery method.

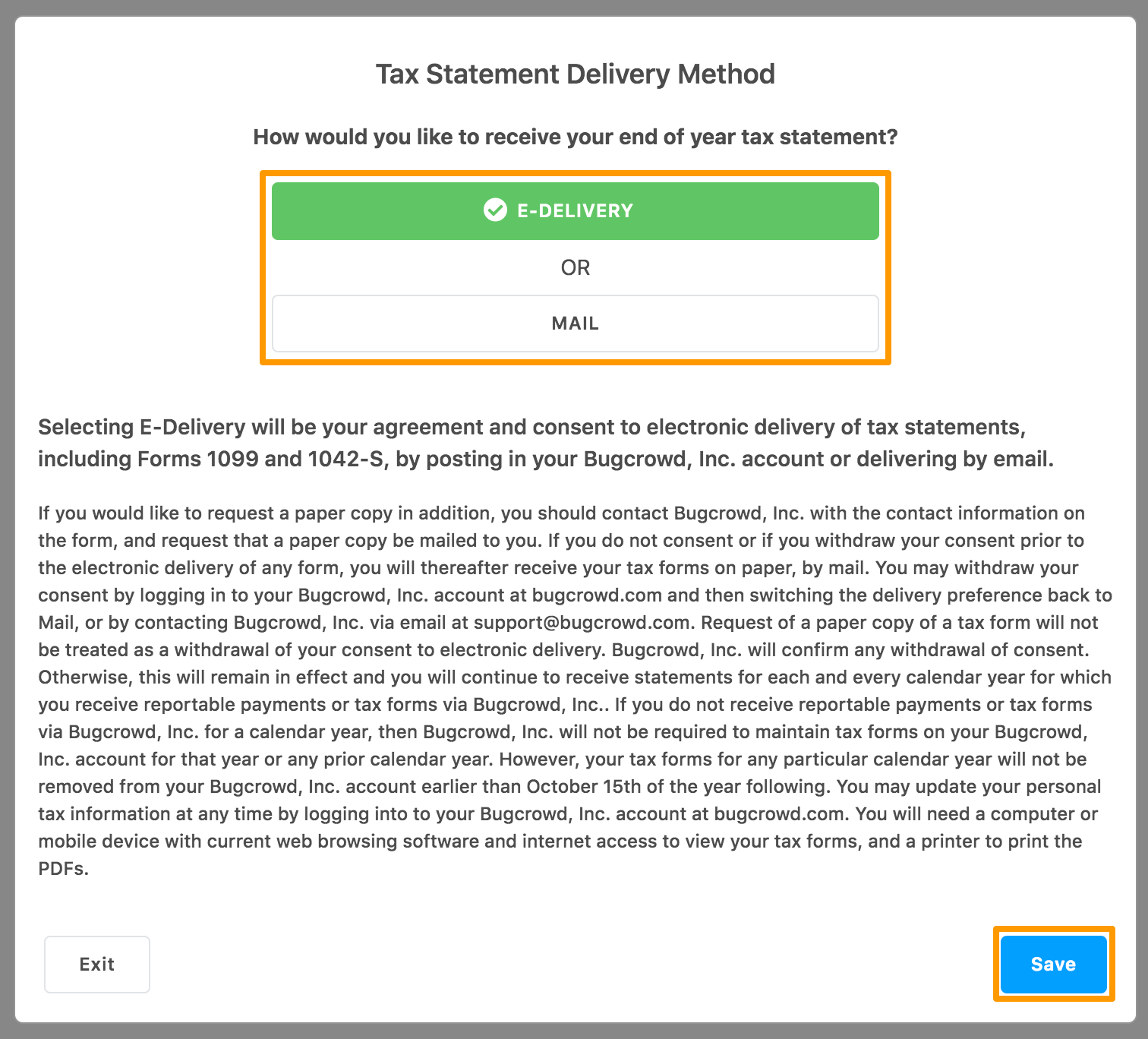

The Tax Statement Delivery Method section is displayed.

-

Click E-DELIVERY or MAIL as per your requirement and click Save.

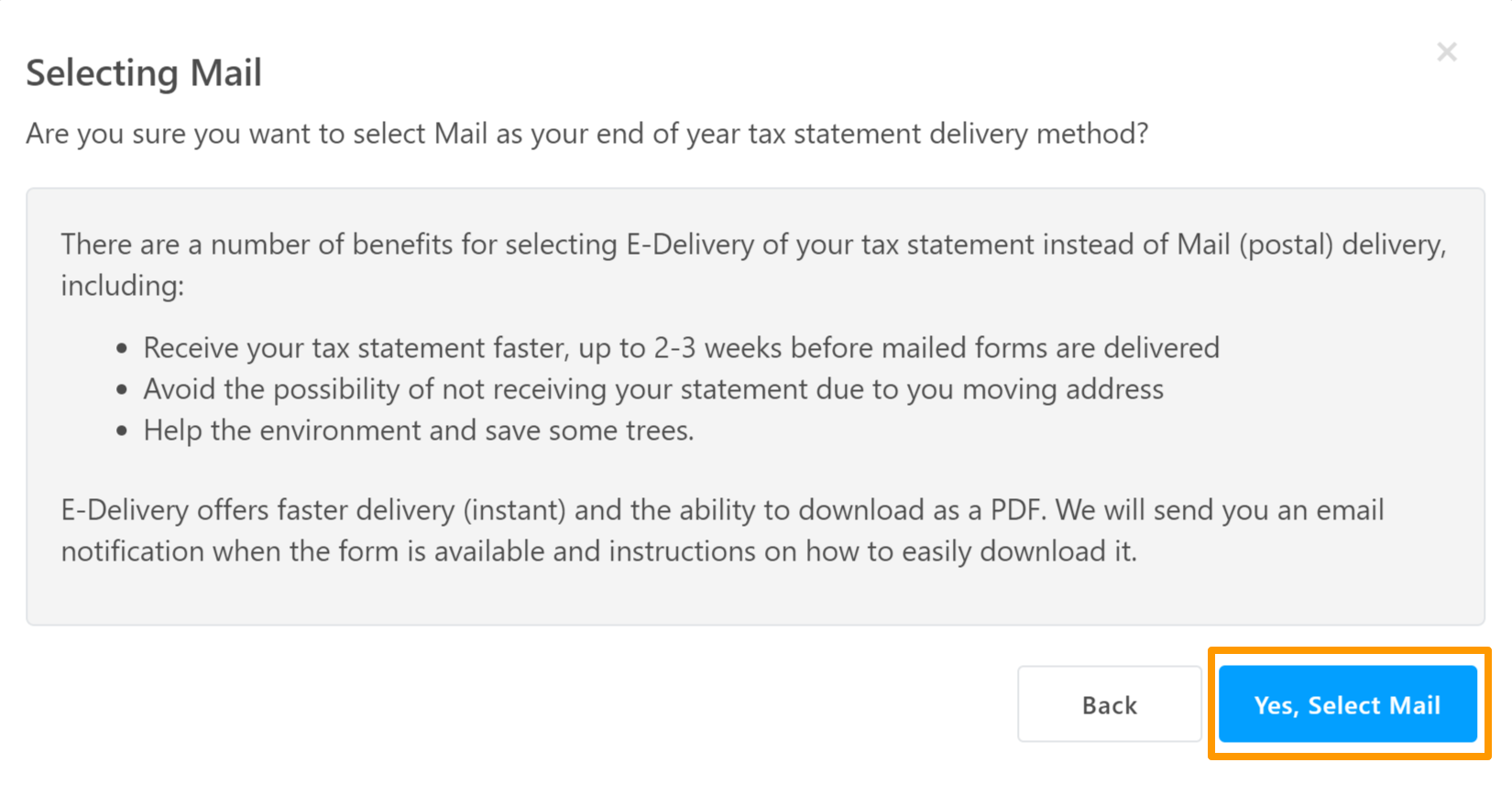

If you have clicked MAIL, the following message is displayed. After reading the information, if you want to continue with the MAIL option, click Yes, Select Mail**.

The delivery method is updated and displayed as shown.