If you are not a U.S. person and an individual, then you must submit the W-8BEN substitute tax form to receive payouts.

To submit the W-8BEN tax form:

-

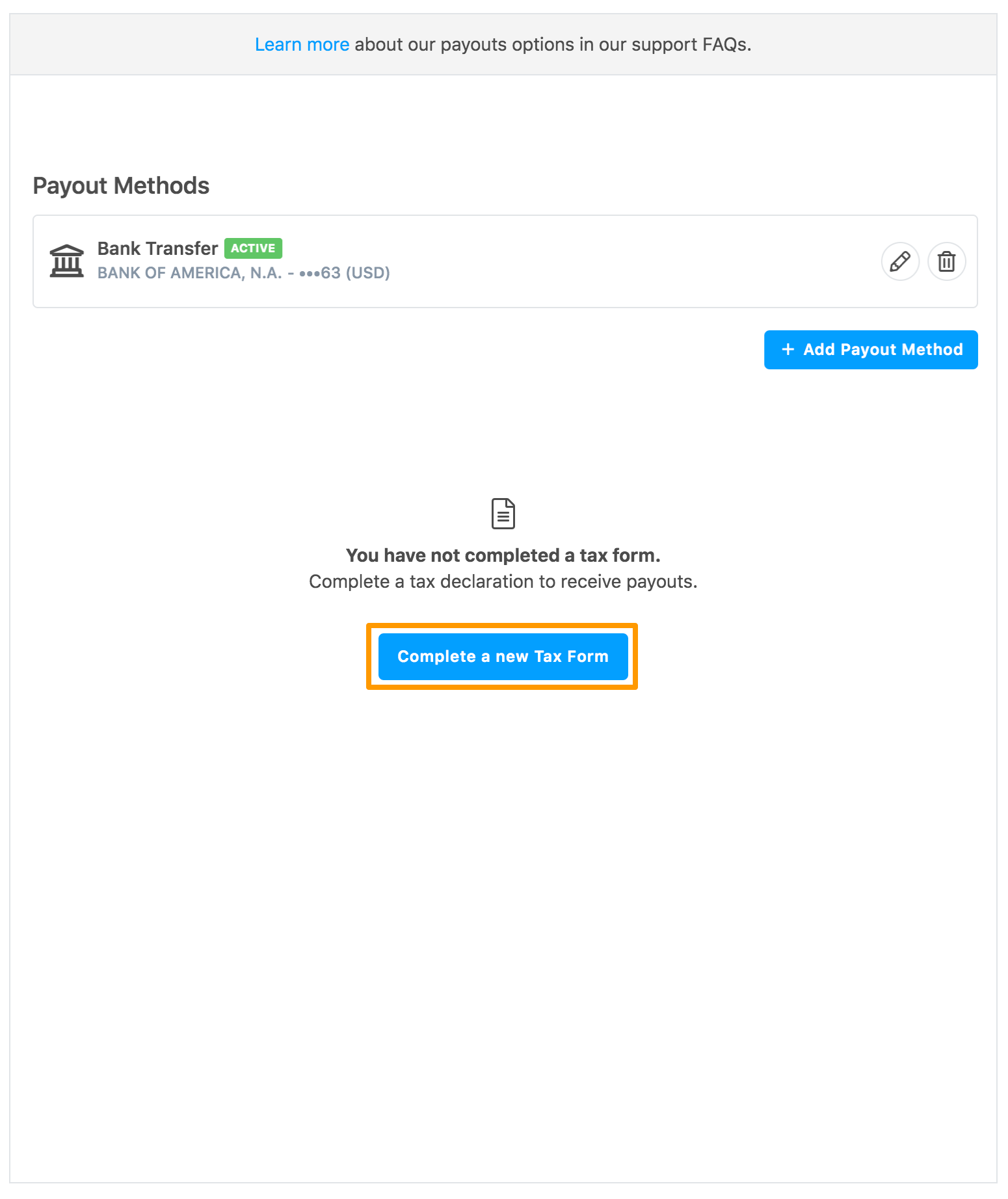

In the Payout Methods section, click Complete a new Tax Form.

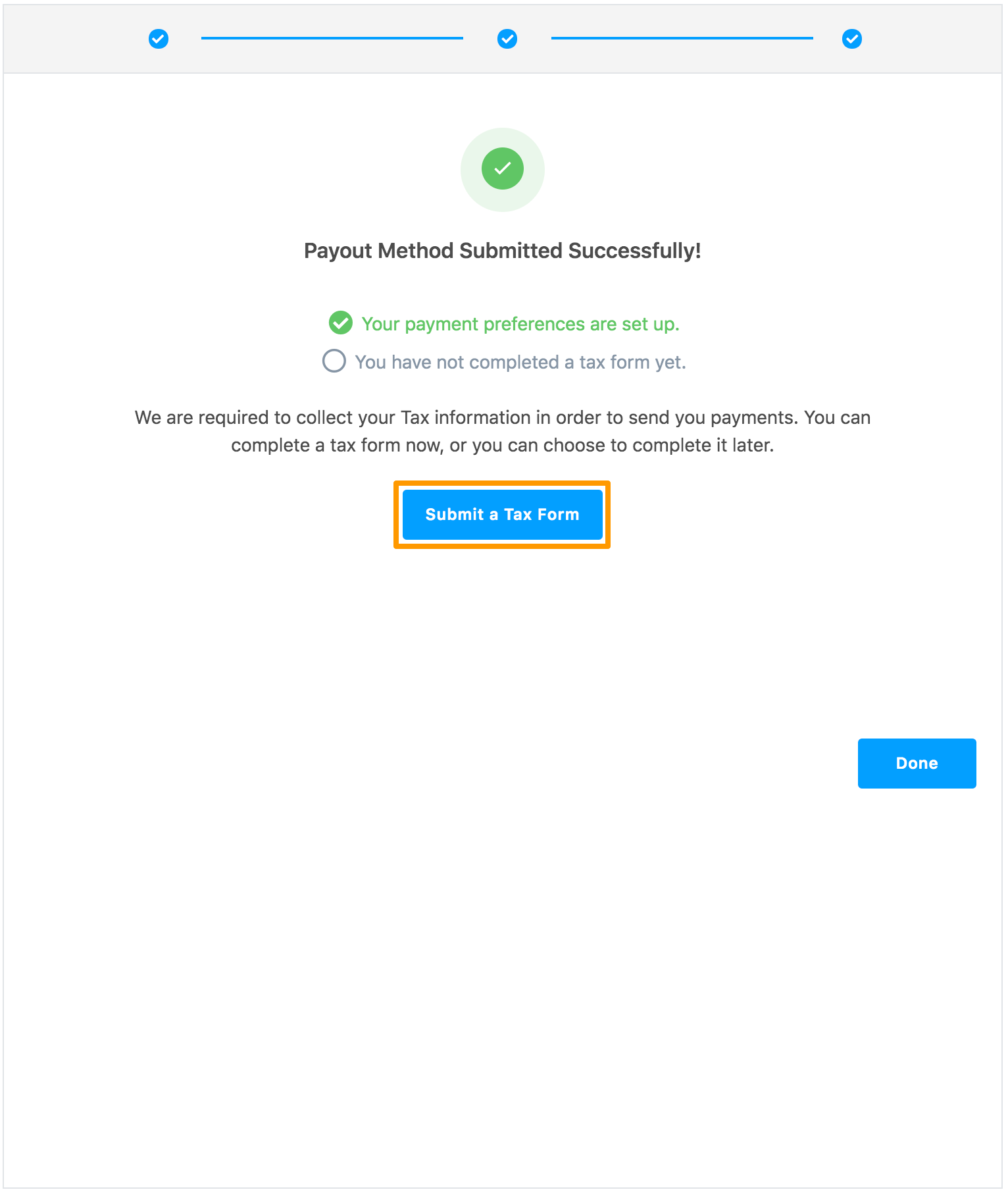

After you add a payment method successfully, you can also submit the tax form.

Click Submit a Tax Form.

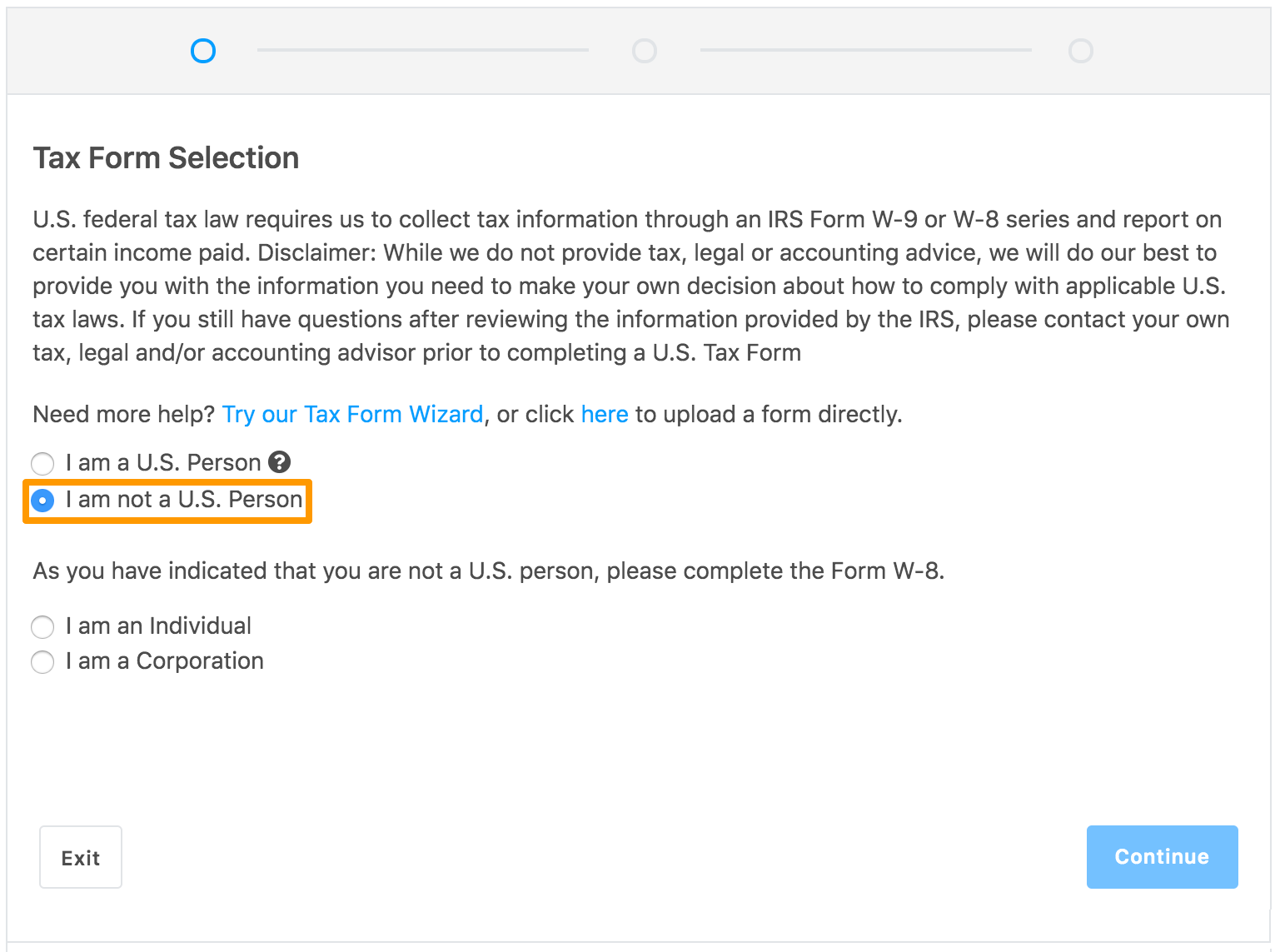

The Tax Form Selection page is displayed.

-

Read the displayed information and then select I am not a U.S. Person. Additional options are displayed.

-

Select I am an individual and click Continue.

The W-8BEN Substitute Form is displayed.

-

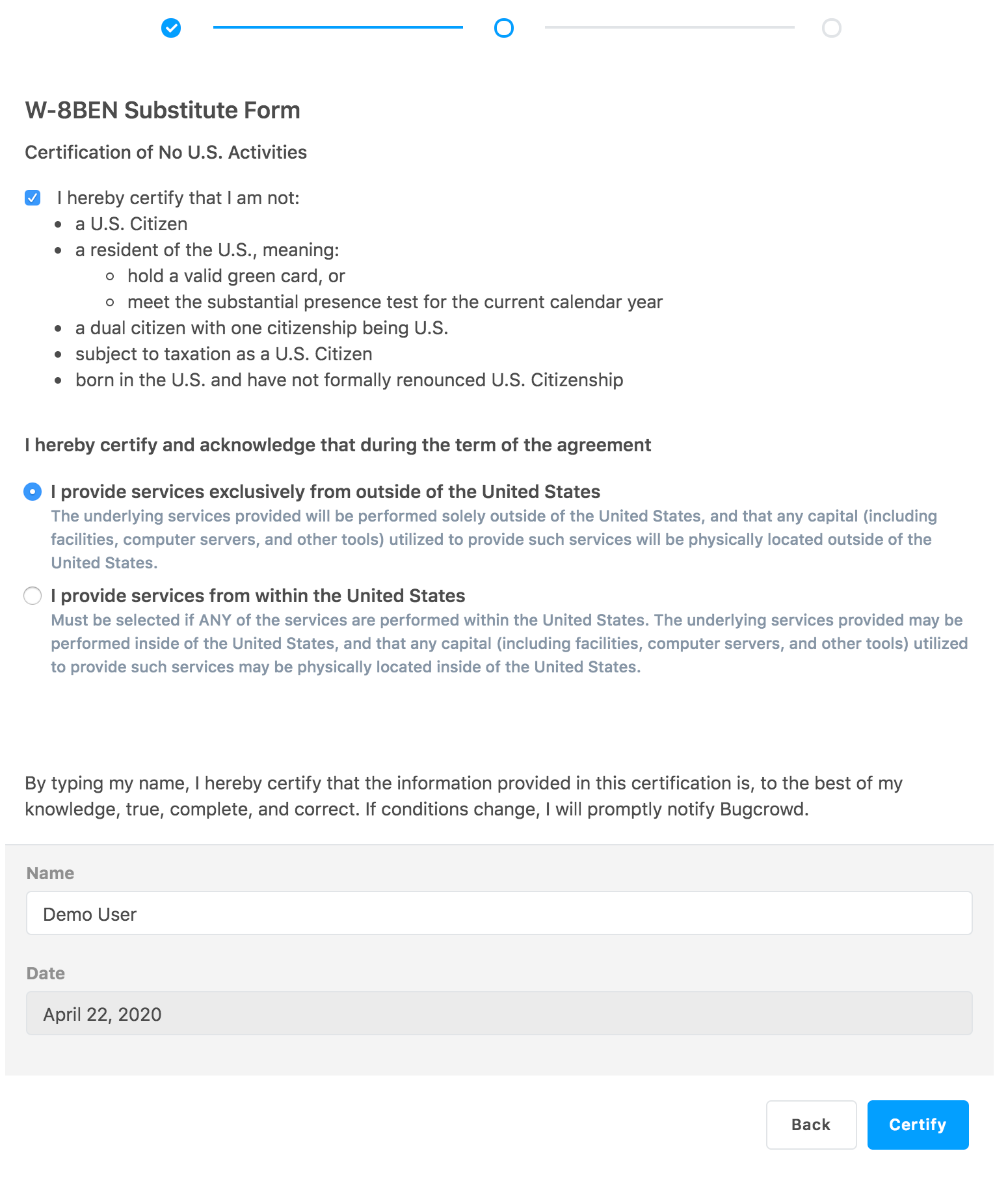

Select the displayed options, provide your name, and click Certify.

The following fields are displayed for individuals.

Here is a list of international Foreign Tax Identification Numbers.

-

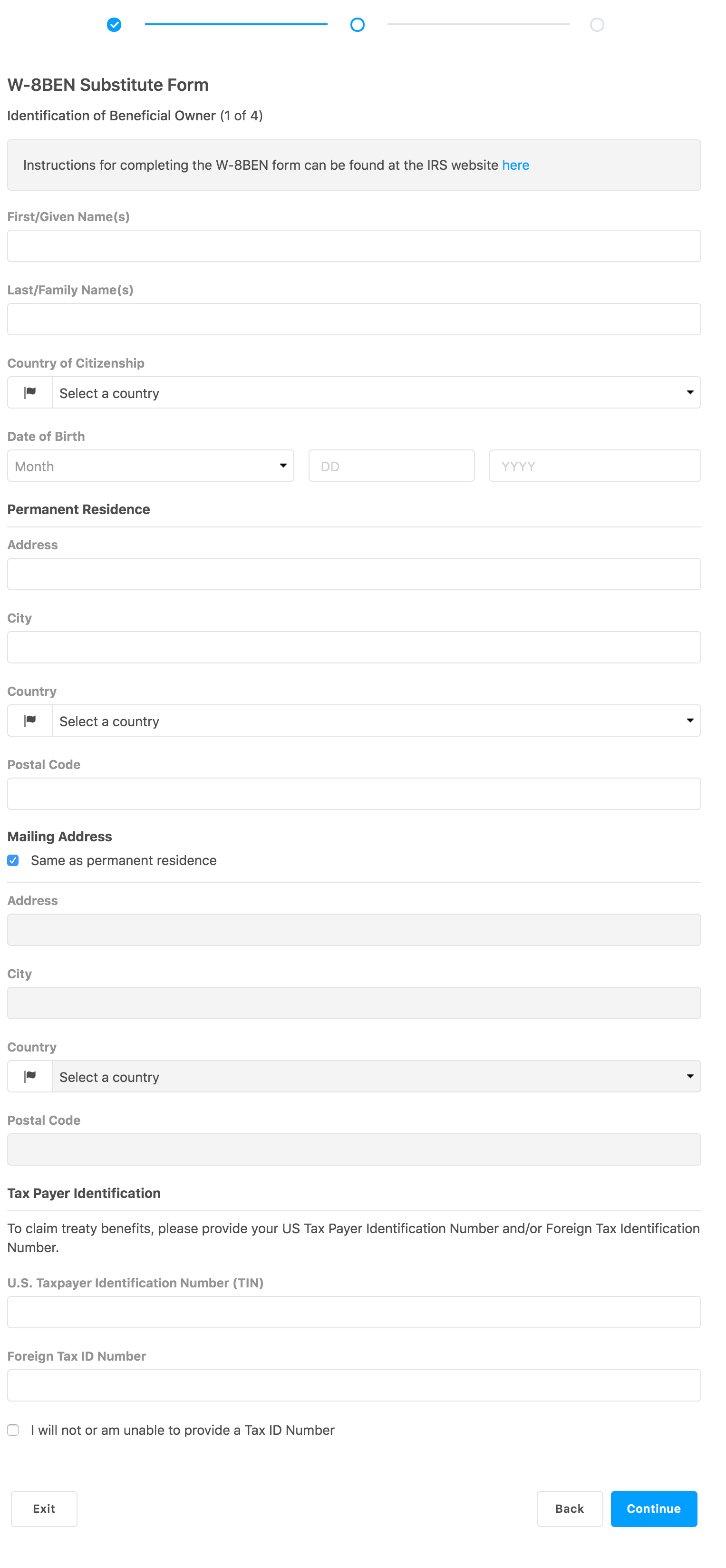

Provide your personal information. For details about the fields, see IRS instructions for W-8BEN form. Click Continue.

If you have selected a treaty country, then the Claim of Treaty Benefits page is displayed.

Note: Accents and other international characters are not supported due to the IRS’ E-file requirements. The valid characters for electronic e-filing are alpha, numeric, blank, ampersand(&), hyphen(-), comma(,), apostrophe(‘), forward slash(/), pound(#), period(.), and percent(%). The percent is valid in the first position only. Do not use special characters that are unique to a language other than English. Using non-valid characters results in an error.

-

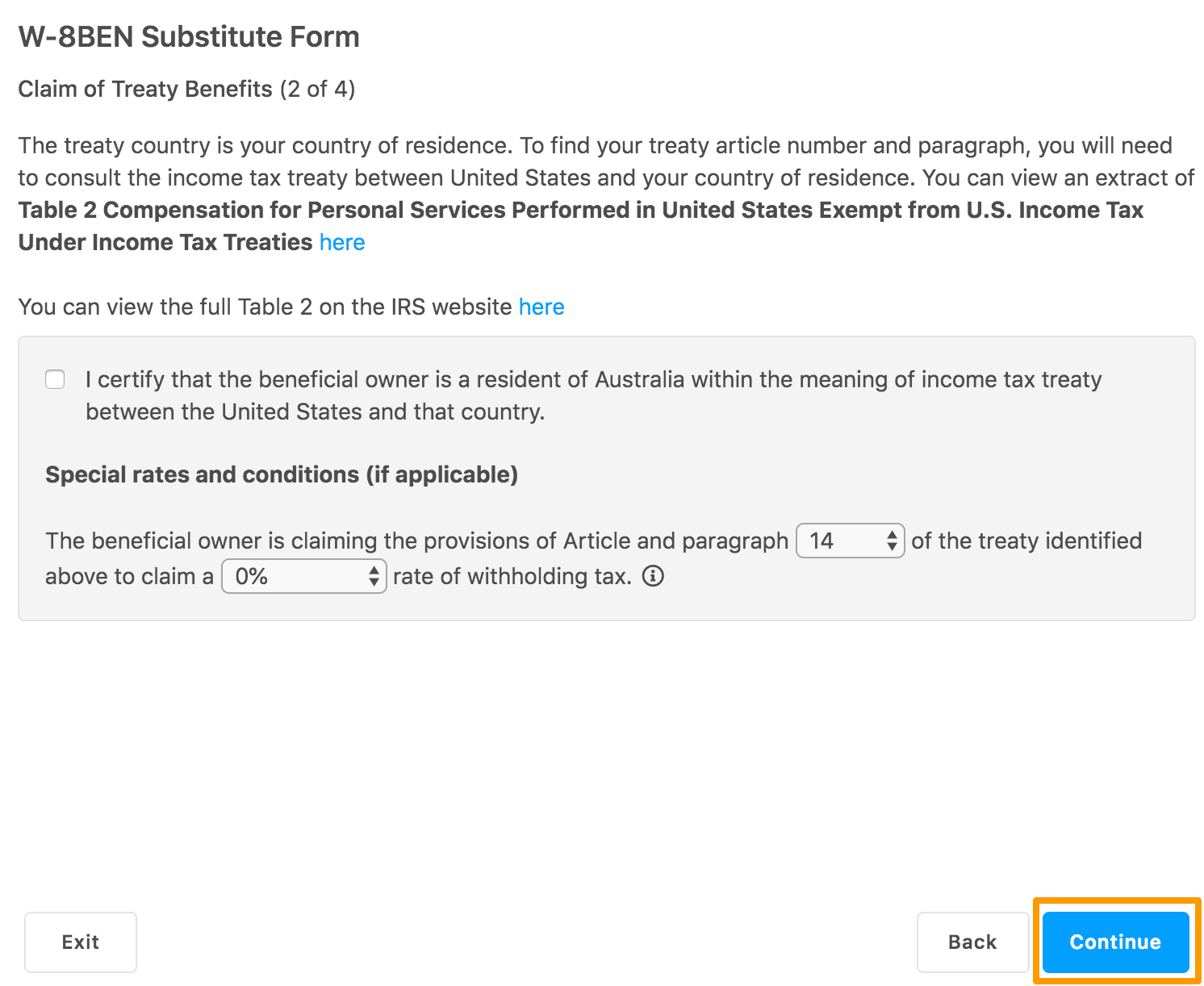

Read the information provided and select the required options. Click Continue. Based on the selected country, this information varies.

The Review section is displayed.

-

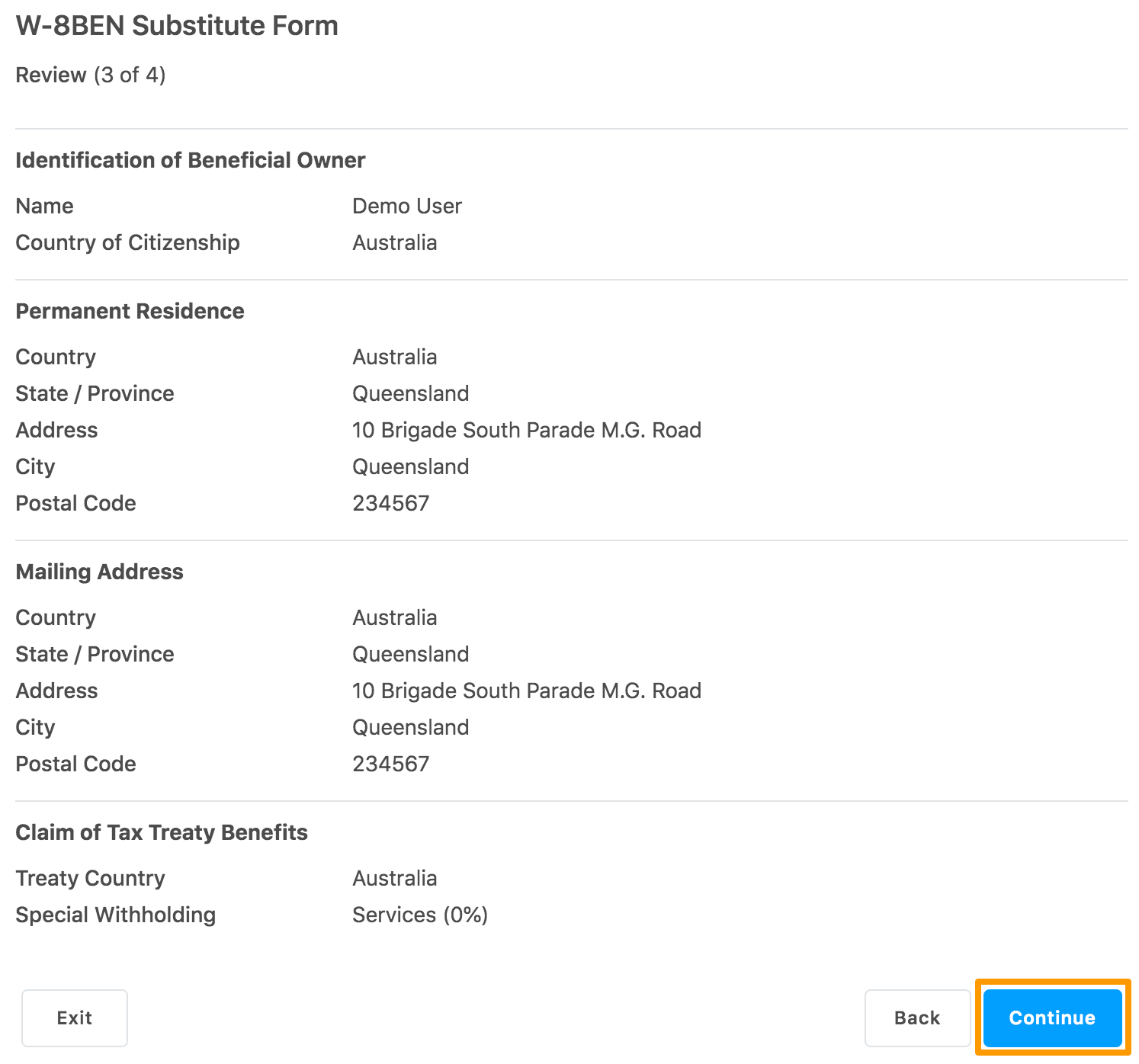

Review the information and click Continue.

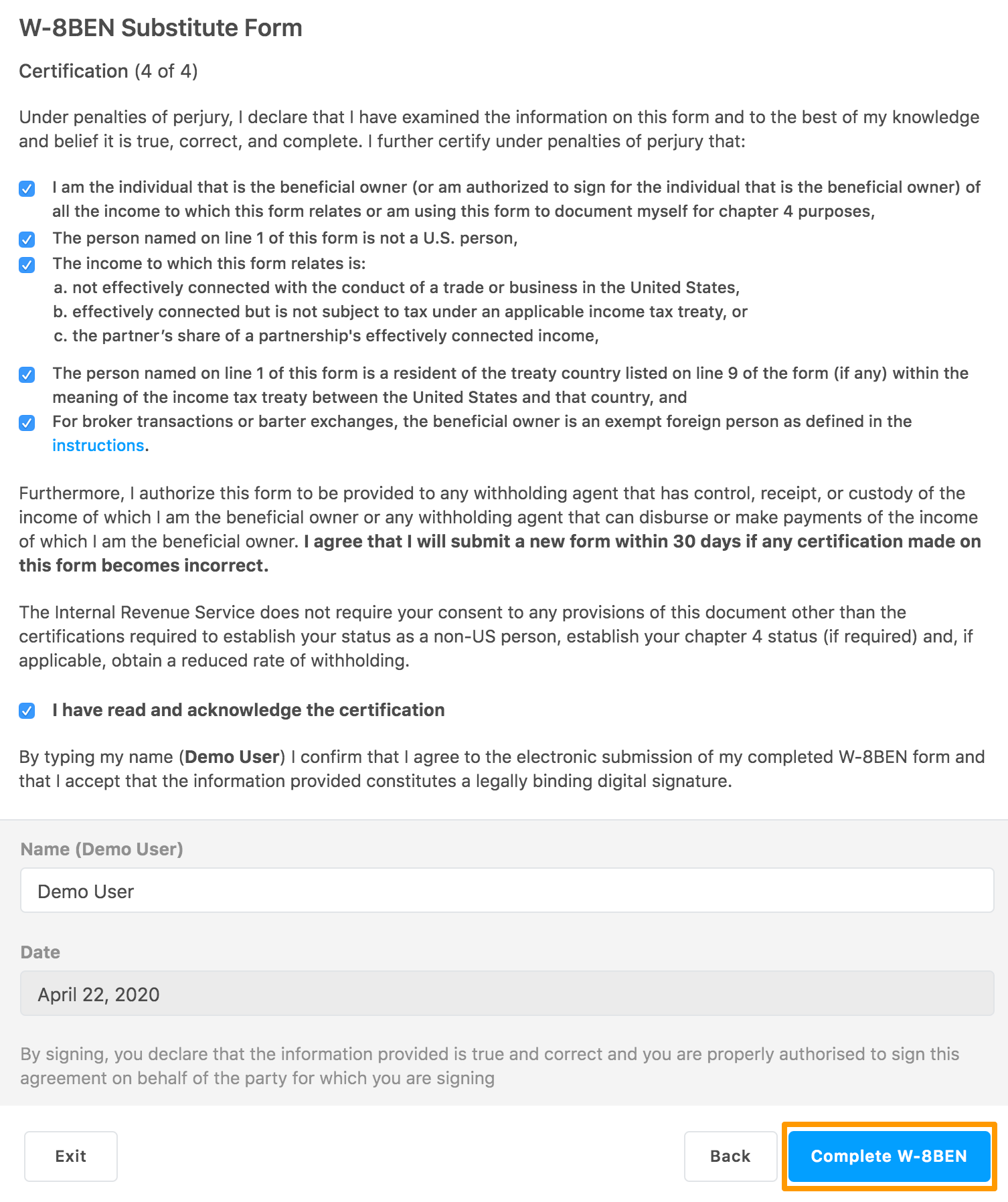

The Certification section is displayed.

-

Select the displayed options, specify your name as per the name on your income tax return, and click Complete W-8BEN.

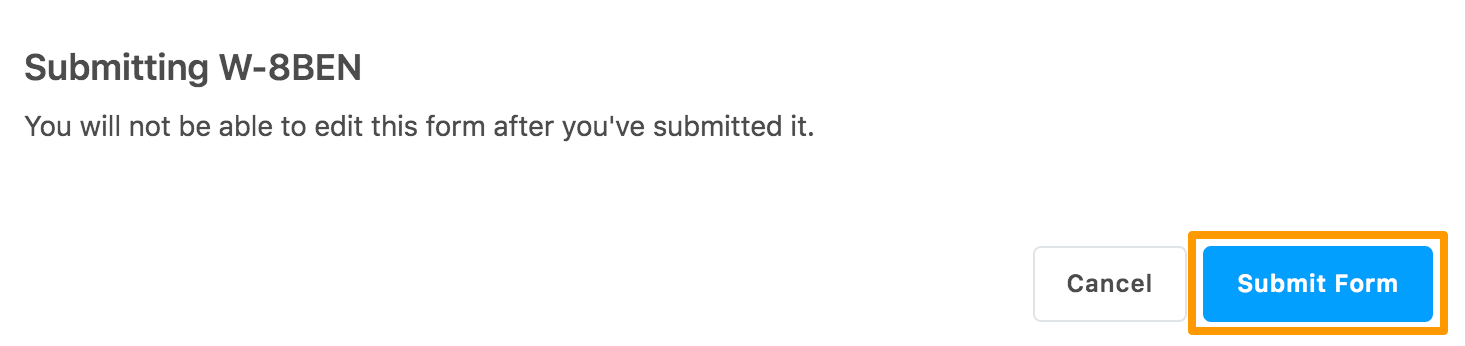

A warning pop-up message is displayed indicating that you will not be able to edit the form after it is submitted.

-

Click Submit Form.

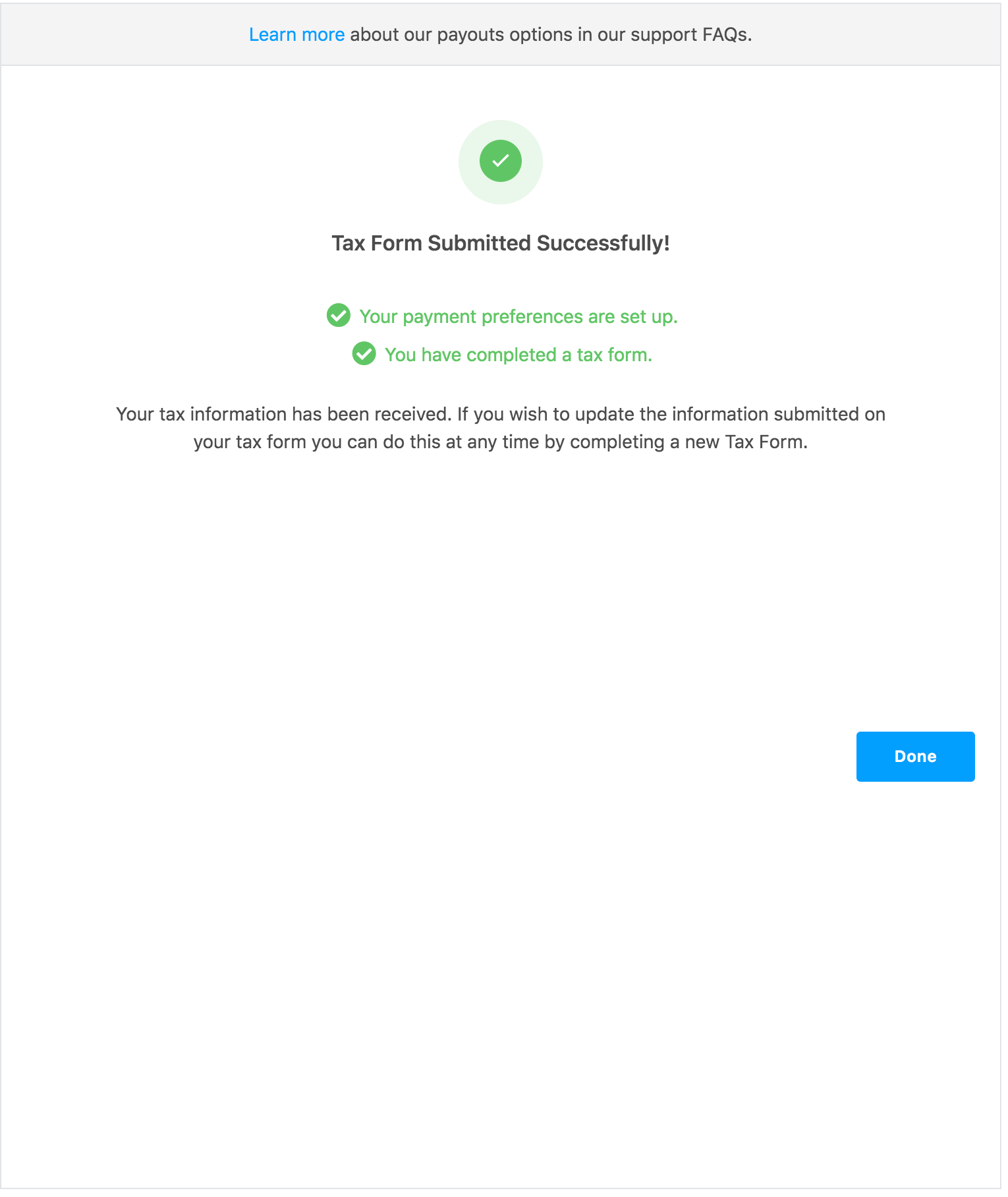

The following confirmation message is displayed.

-

Click Done to close the message.

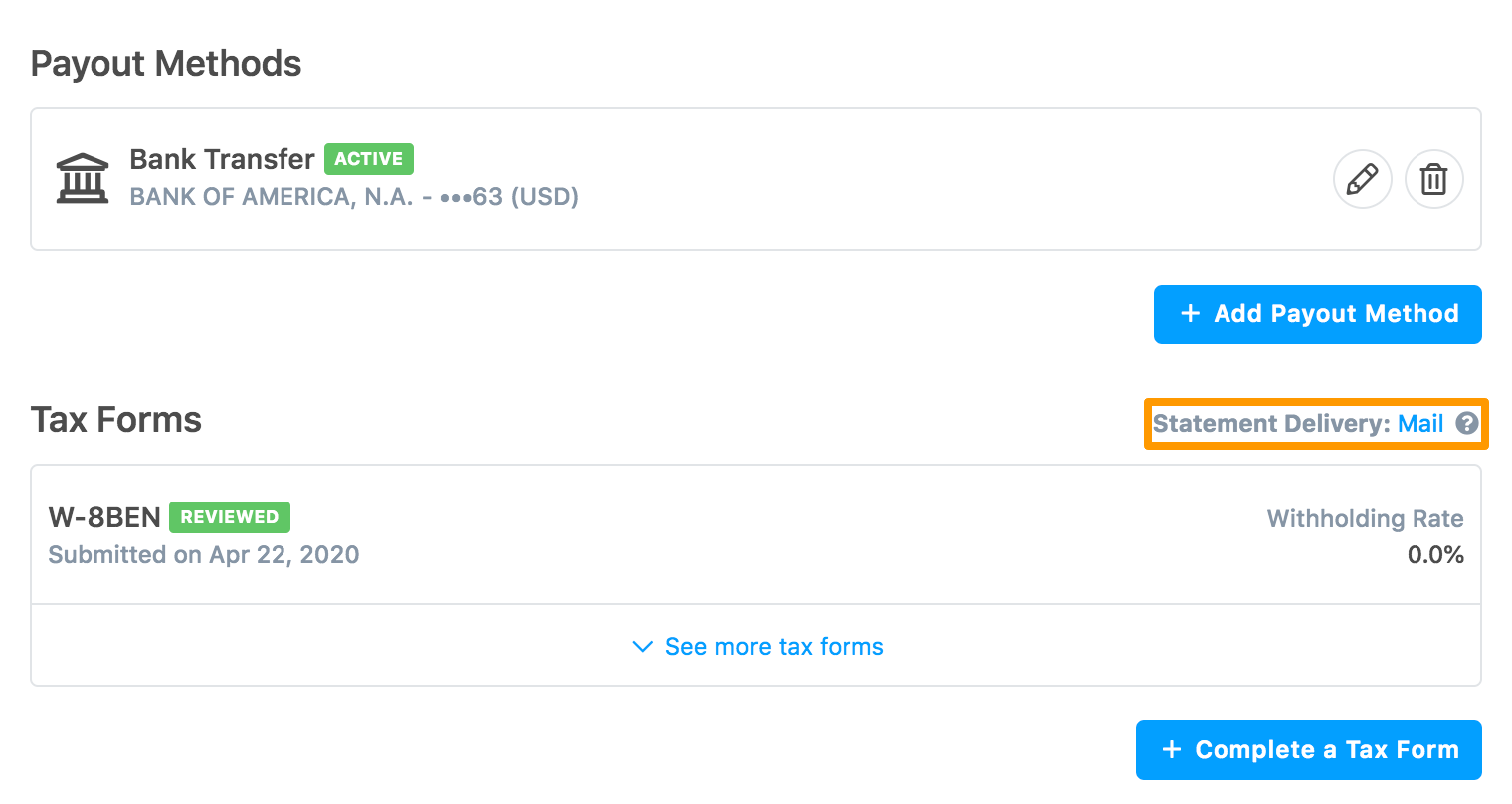

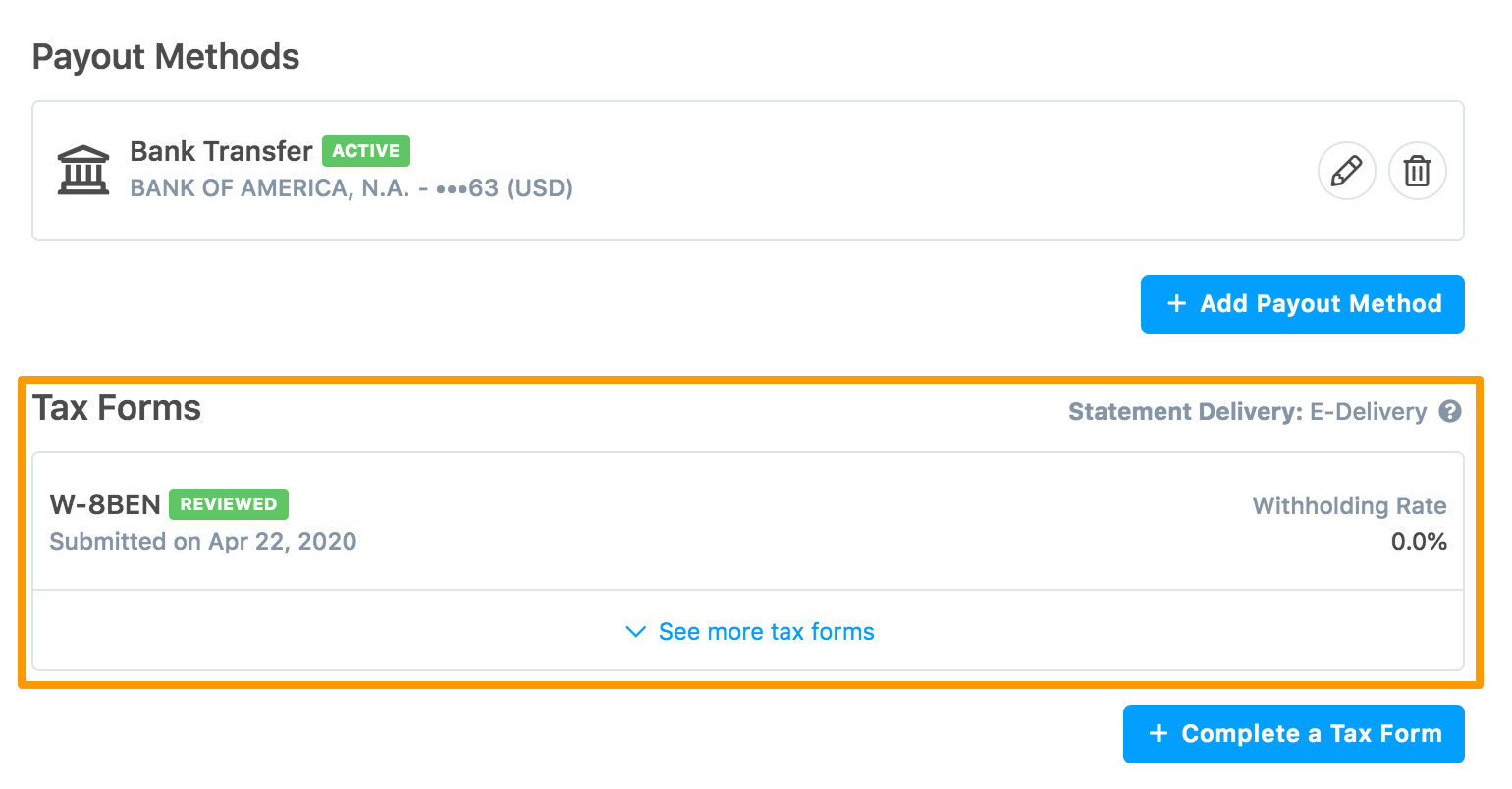

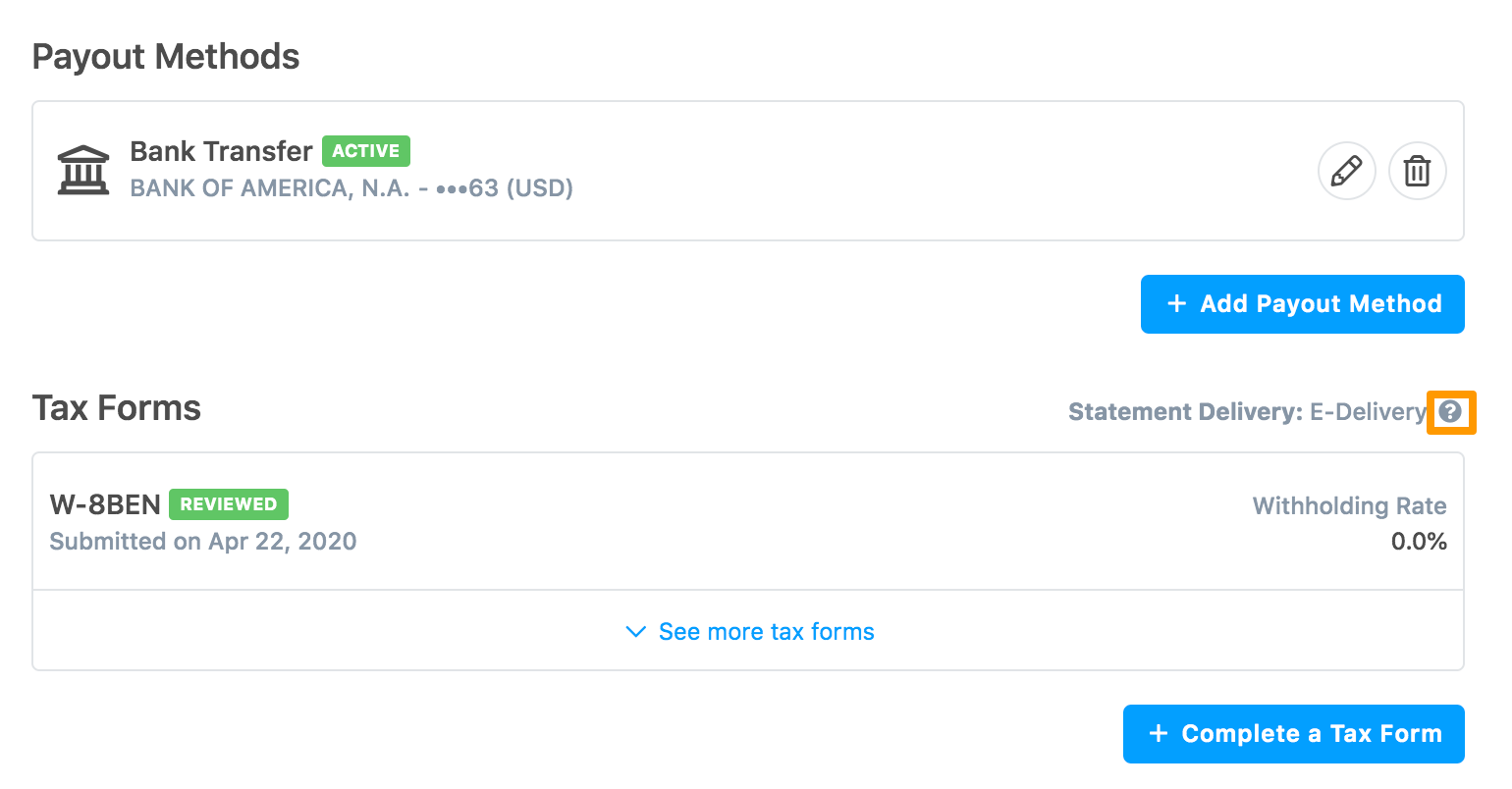

The submitted tax form is displayed in the Tax Forms section.

-

In Statement Delivery, click the question mark icon for specifying the tax statement delivery method. By default, it is E-Delivery.

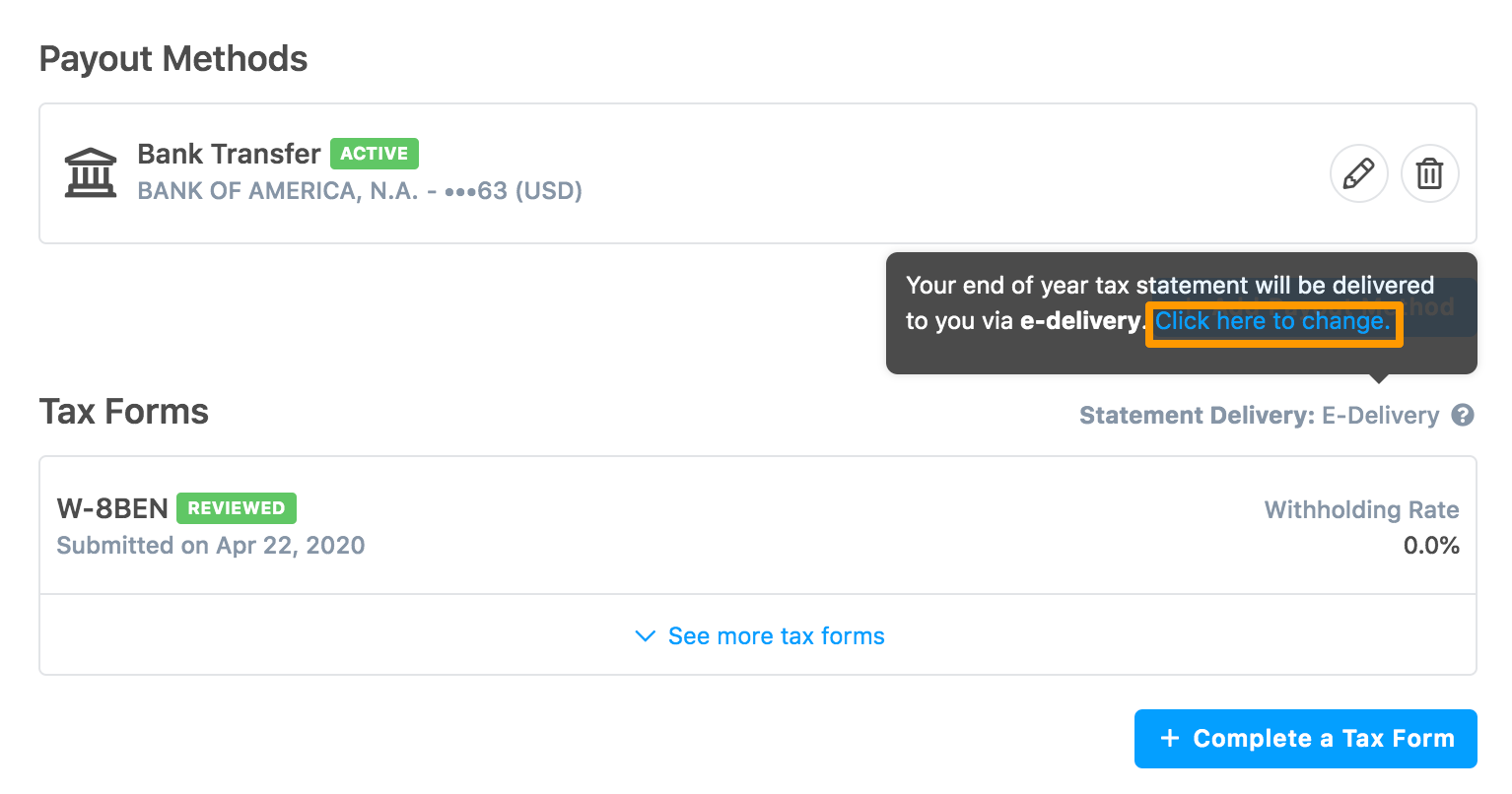

A pop-up message indicating the current delivery method is displayed. Click the link to change the tax statement delivery method.

The Tax Statement Delivery Method section is displayed.

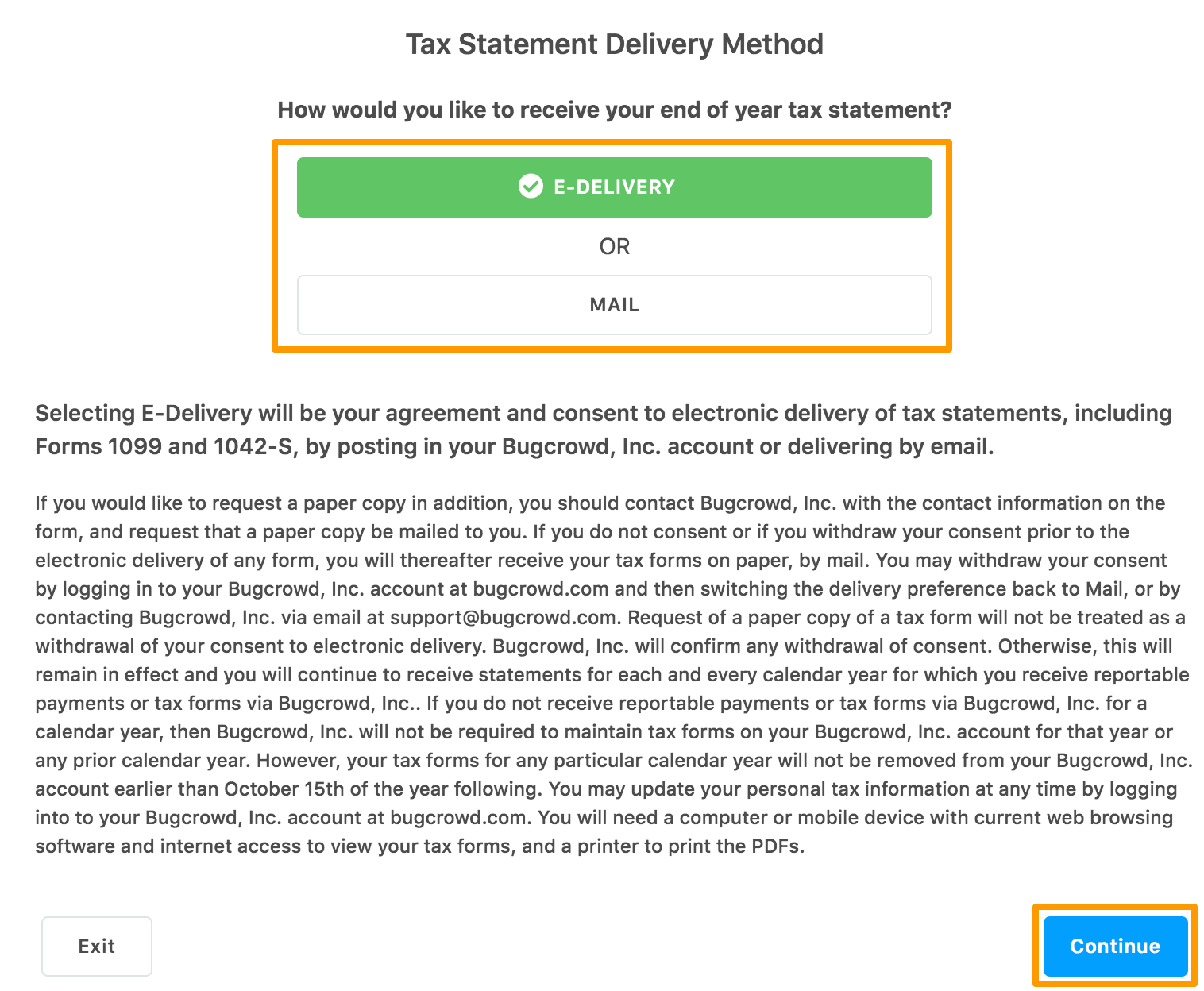

-

Click E-DELIVERY or MAIL as per your requirement and click Save.

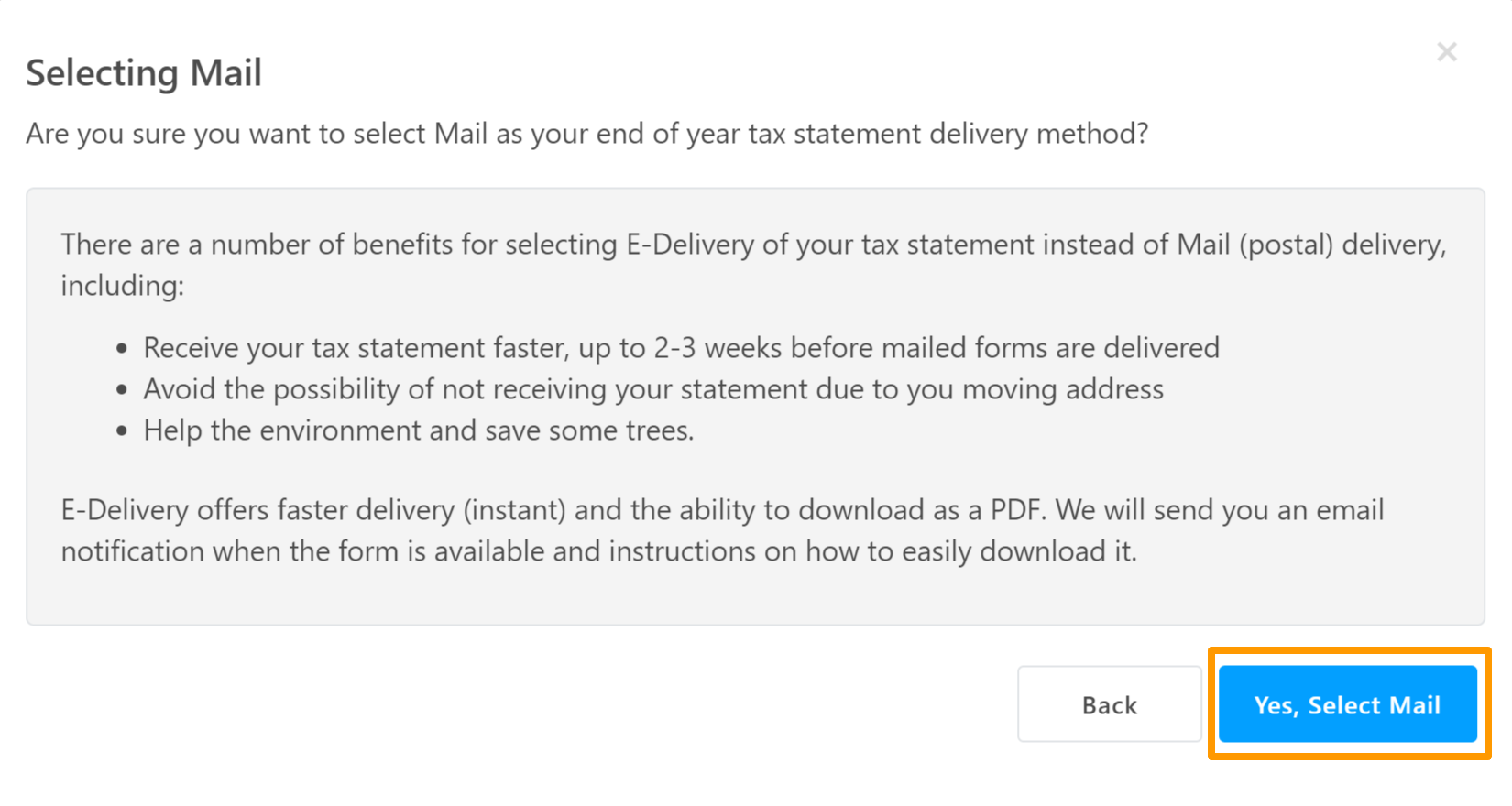

If you have clicked MAIL, the following message is displayed. After reading the information, if you want to continue with the MAIL option, click Yes, Select Mail.

The delivery method is updated and displayed as shown.